Marketer-in-chief: Geopolitical shocks roil energy markets at the start of 2026

January 13, 2026

Geopolitical tensions in Venezuela and Iran are firmly in the spotlight, setting the early-year tone for risk across global energy markets.

For crude, any rebound in Venezuelan output is expected to be gradual and incremental, but a shift in trade flows is already underway. In clean product markets, gasoline prices in the Atlantic basin have rallied at the start of the year, though softer fundamentals could soon put a lid on further gains. Meanwhile, diesel markets remain under pressure amid ample supply. Refining margins are hovering just above run-cut thresholds, and any reallocation of Venezuelan barrels is poised to have a far greater impact on crude markets than on refined products.

Geopolitical risks will remain elevated as the Iranian regime’s political crisis deepens, with intensifying protests and repeated warnings that the US could intervene. Oil and gas markets are bracing for a range of potential scenarios, each carrying sharply different implications. Macro risks are also front and centre, with mixed US data, shifting inflation and tariff uncertainty clouding the outlook. In gas markets, cold weather has tightened European balances and buoyed TTF, while JKM–TTF spreads have narrowed as freight rates collapse. In North America, mild weather and high storage continue to weigh on Henry Hub.

Crude Oil

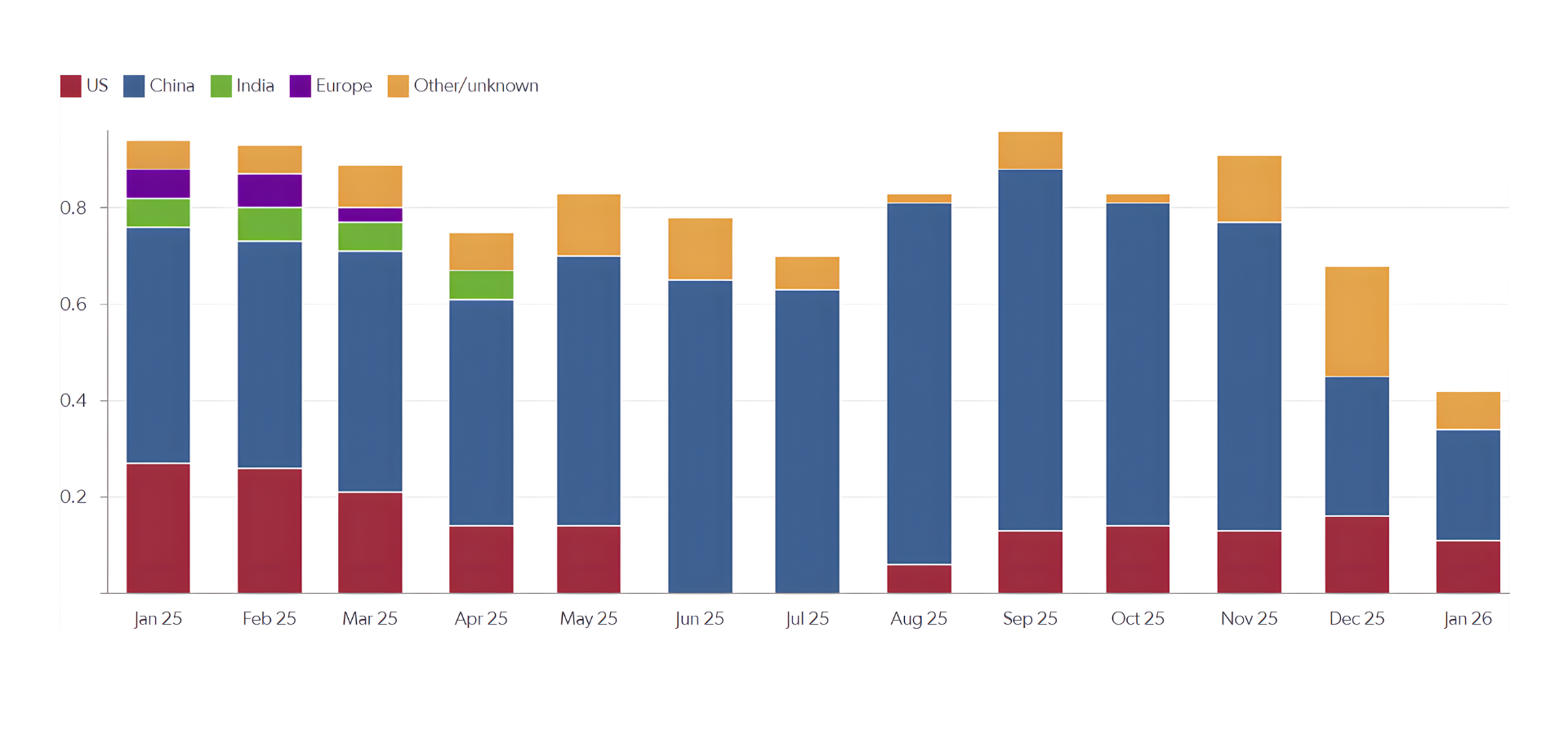

Oil prices started 2026 on a volatile note, rebounding after initial losses tied to Venezuela’s political turmoil. While traders weigh short-term supply risks, positioning tailwinds—including the unwinding of decade-high managed money shorts—are supporting prices. Venezuelan output recovery will be slow, with legal and operational hurdles limiting gains. Immediate trade-flow shifts will come from Washington’s plans to market Venezuelan barrels, not increased production.

Despite ubiquitous bearish sentiment in the market, supply–demand balances may prove tighter than expected overall, as seen throughout 2025.

Oil Products

Gasoline prices in the Atlantic basin have found support from refinery outages and increased CTA buying, but further gains are likely to be capped by rising inventories and subdued US demand. Meanwhile, diesel cracks remain under pressure, with the market well supplied thanks to strong runs in Europe and the US Gulf Coast, alongside steady inflows from the Middle East. Even with the EU’s “refining loophole” ban set to take effect on 21 January, we expect diesel margins to stay soft given the abundance of supply.

Figure 2: European diesel inventories, mb - Source: OilX, Energy Aspects

Refining

Refining margins are just above run-cut levels, supported by high utilisation rates. The potential reshuffle of Venezuelan crude flows is expected to have only a minor impact on product yields, with USGC refiners able to absorb additional heavy barrels. We forecast margins to average $5/bbl in 2026, slightly down y/y, but up from 2024, with stronger performance in H1 26.

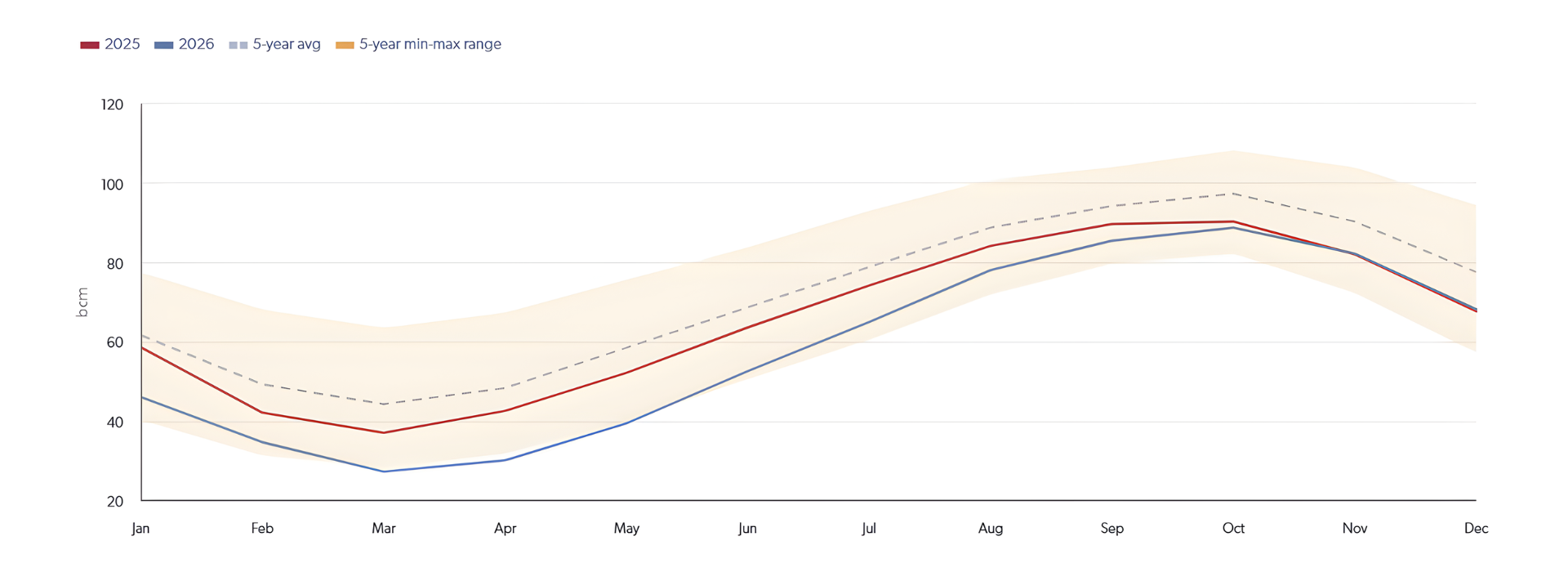

Europe Gas

Cold weather has tightened

European gas balances, supporting TTF prices. Our price-sensitivity model suggests Europe would have only 25 bcm in stocks by end-March at current market prices—down by 12 bcm y/y and 37 bcm below the 2023–24 average. This lack of late-winter stocks underpins our bullish view on TTF near-curve prices through the rest of winter and into 2026. The risk of a Russia–Ukraine peace deal remains a key downside factor for prices.

Figure 3: European storage level, bcm - Source: Energy Aspects, GIE

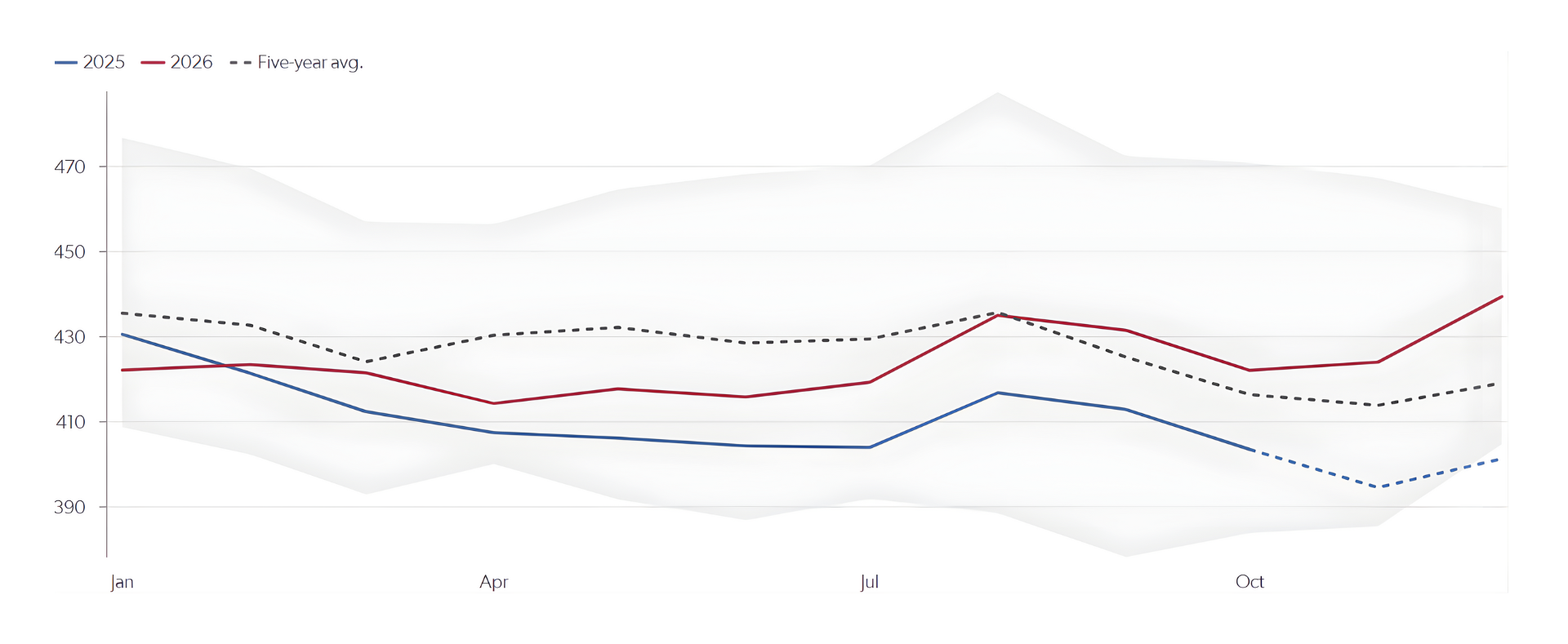

North America Gas

Mild weather and high storage levels continue to weigh on Henry Hub prices, despite strong LNG feedgas demand and record production. The market remains loose, with the next tightening event likely to come from the ramp-up of feedgas flows to

Golden Pass.

Global LNG

JKM–TTF spreads have narrowed as freight rates collapse and supply to east-of-Suez markets increases. A significant y/y boost to baseload east-of-Suez supply is expected this year from the full ramp-up of

LNG Canada, reducing the need for West African cargoes and shifting more US spot cargoes towards Asia.

Geopolitics

The

geopolitical premium in oil prices is set to persist as focus shifts from Venezuela to Iran. Widespread protests continue despite a mounting death toll and intensified government crackdown. Markets are weighing scenarios from supply disruptions to regime change. President Trump reiterated possible US intervention, though officials are likely to recommend economic and cyber measures over military action. Israel is also considering ways to pressure Iran.

Marco

Macro uncertainty persists, with mixed US economic data, shifting inflation and potential tariff changes keeping risks elevated. The outlook remains clouded, with markets sensitive to new developments on both the economic and geopolitical fronts.

This article was first published on LinkedIn. For a deeper dive into this topic and to stay updated with our latest insights,

you can access the full newsletter here.