ExxonMobil's Golden Pass still on track for first LNG exports this March but risk of slippage

4 February 2026

ExxonMobil’s Golden Pass LNG project in Texas is one of the most closely watched developments in the global LNG market. With a nameplate capacity of 6 Mtpa for Train 1, Golden Pass is set to become a major new source of US LNG supply. Its commissioning and ramp-up are expected to have a significant impact on global gas balances, US feedgas demand, and Atlantic Basin trade flows - making the timing of its first exports a critical market signal for traders, analysts, and portfolio managers worldwide.

EA Live Market Update on 30 Jan 2026, 15:59

We still expect ExxonMobil's 6 Mtpa Golden Pass LNG Train 1 to load two cargoes in March, aligning with the company’s comment that it expects first LNG in March. Feedgas nominations have dipped slightly to 24 mmcf/d, from a 26 mmcf/d peak on 23 January, but remain broadly stable. Golden Pass received FERC approval to introduce hazardous fluids into the fuel gas system and ground flares—a standard pre-commissioning step.

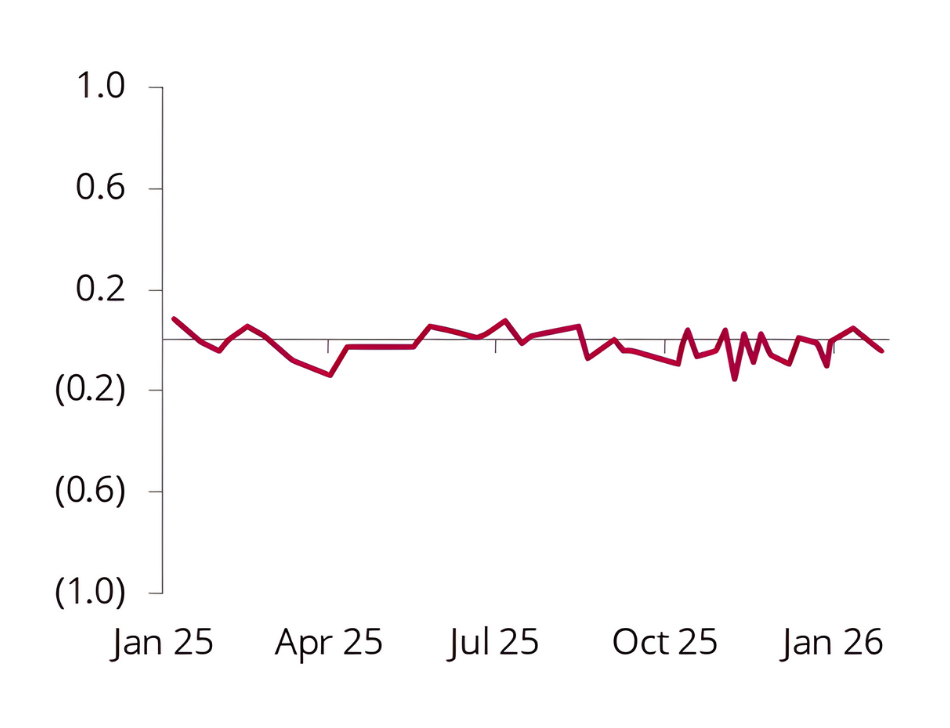

However, we see no spike on our thermal index, indicating the train is still cold and not liquefying. ExxonMobil's comments reinforce this view. A separate FERC permit for LNG production and storage systems is still required and unfiled. There is risk of slippage into April given ongoing commissioning.

Golden Pass Train 1 thermal index

Source: Energy Aspects

30 Jan 2026, 15:59

Actionable intelligence, delivered first

The brief uptick in feedgas flows at the end of January 2026, sparked speculation about an early start to liquefaction. However, our proprietary thermal index and real-time monitoring told a different story. Despite the increase in flows, there was no corresponding heat signature, an essential indicator that liquefaction had not begun.

Through EA Live, our clients received a clear, actionable update: Golden Pass remains on track for first LNG exports in March, in line with commissioning progress and regulatory requirements. We also flagged the risk of potential slippage into April, providing a balanced view of the operational timeline.

Why this matters:

The start-up of Golden Pass LNG will reshape near-term supply dynamics and influence price signals across the Atlantic and beyond. Accurate, real-time insight into commissioning progress and export timing is essential for market participants seeking to manage risk and capture opportunity.

Energy Aspects’ Global LNG and North American gas EA Live service provides you with timely, data-driven updates that cut through market noise. Our proprietary analytics and on-the-ground intelligence ensure you receive the facts, before the market reacts.

Don’t rely on lagging indicators. Get ahead with Energy Aspects.

Interested in learning how EA Live can support your trading and portfolio strategies? Request a trial here.

This insight was originally published for EA Clients on 30 January 2026.