Final exit ramp: Volatility reigns as US–Iran standoff persists

February 11, 2026

Energy markets remain highly volatile as geopolitical tensions continue to cloud the 2026 outlook. US–Iran talks are set to resume this week after limited progress in the initial round on 6 February. The risk of military escalation, and a corresponding geopolitical risk premium in oil prices, will rise sharply if President Trump perceives Iran as unwilling to compromise.

In refined products, a timely ramp-up at Nigeria’s Dangote refinery is poised to soften Atlantic basin gasoline fundamentals. Diesel prices meanwhile have weakened, with ample prompt supply outweighing robust heating demand expectations. While refining margins are steady, increased flat price volatility is heightening operational risks for refiners.

Global macro sentiment has worsened, with early-year optimism about growth fading rapidly. In natural gas, we see upside for TTF as European storage remains tight, and JKM–TTF spreads appear undervalued. Conversely, Henry Hub is likely to come under pressure as milder weather forecasts emerge.

Crude Oil

We expect oil markets to stay volatile, with multiple scenarios possible for Iran’s oil and gas output depending on political developments and US policy choices. Even if US president Donald Trump were to accept a nuclear-only deal—a scenario that is highly uncertain—major sanctions relief is unlikely. At best, Iran may avoid military strikes and further curbs on oil sales to China.

Traders are likely to remain cautious about shorting crude, a stance reinforced by fundamentals,

as there is still no clear evidence of the widely anticipated 2026 glut. If oversupply fails to materialise soon, the market narrative could quickly shift. Rather than selling rallies—a strategy that has dominated for the past two years—buying dips may become the new norm.

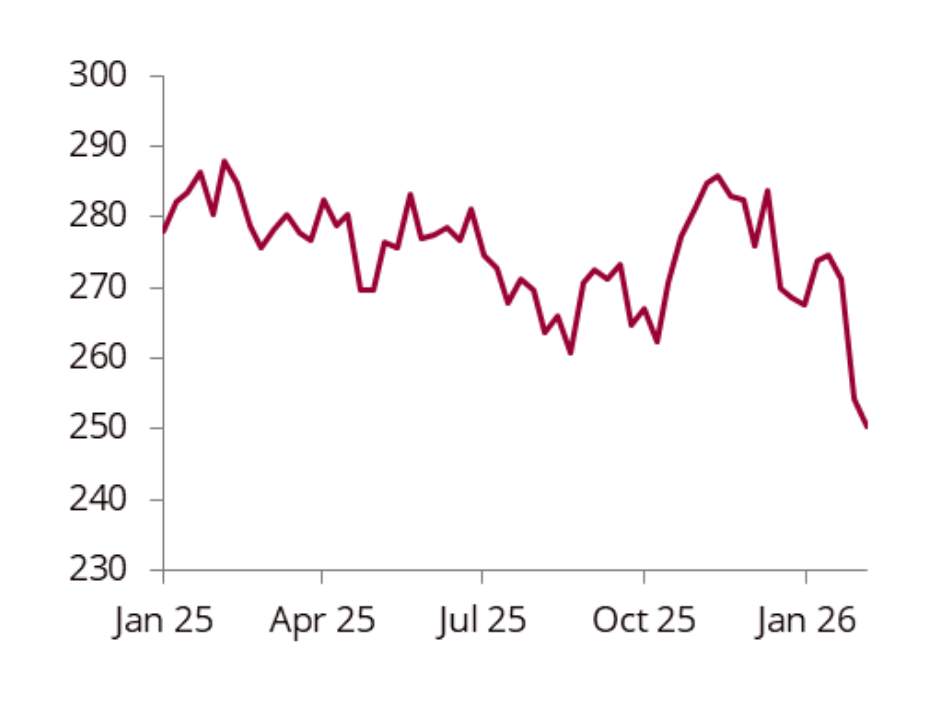

European high-frequency crude stocks, mb

Source: OilX, Energy Aspects

Oil Products

The ramp-up at Nigeria’s Dangote refinery is set to weigh on prompt gasoline spreads, with higher crude inputs signalling an end to elevated European imports. We expect this shift to pressure European prices and allow for more exports to the US.

Diesel prices have softened as prompt supply remains ample, despite robust heating demand expectations. Unless major outages or a significant US storm boost demand, NYMEX heating oil spreads should continue to ease, while ICE gasoil timespreads may find support after the Feb-26 expiry as European refinery maintenance ramps up.

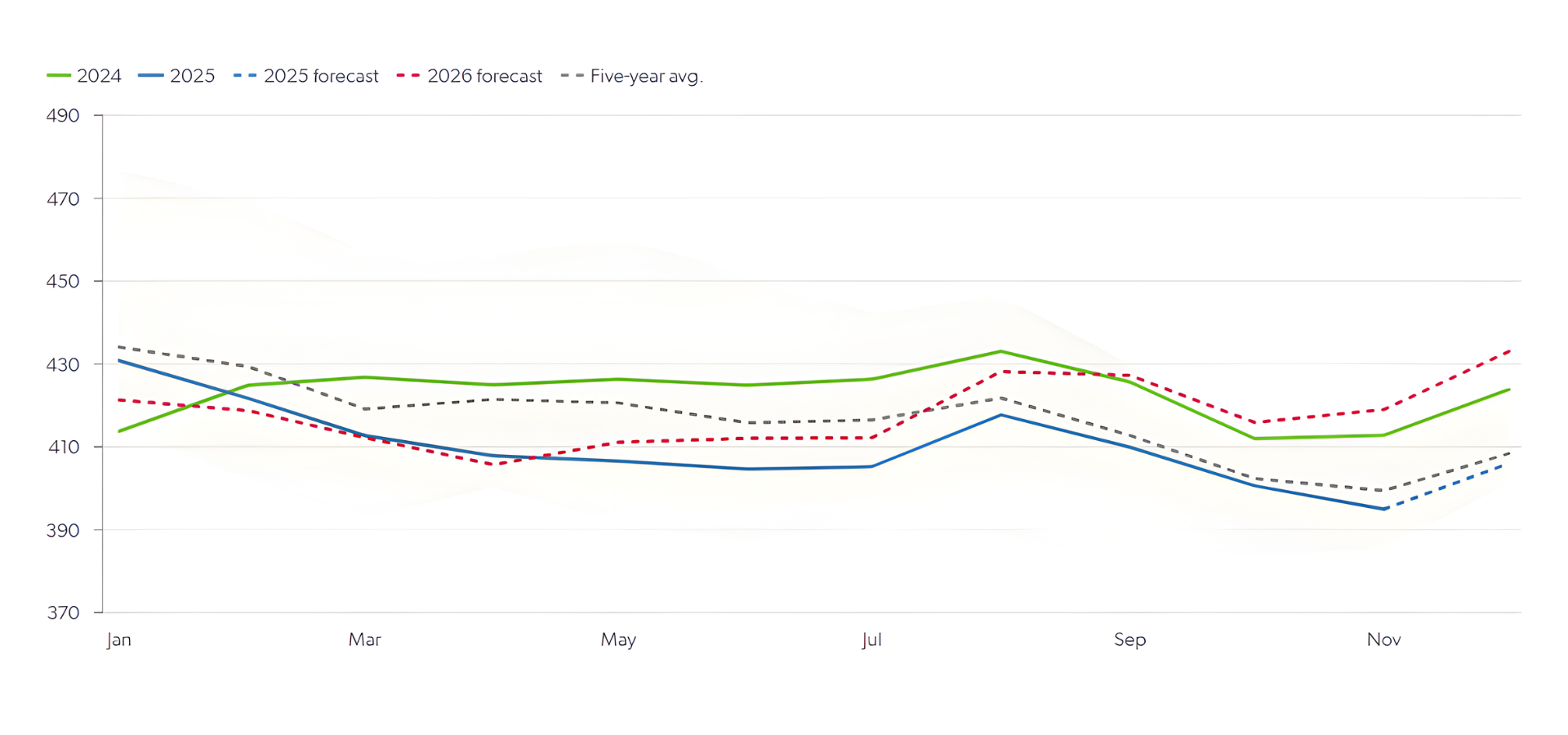

Europe diesel inventories, mb

Source: OilX, Energy Aspects

Refining

Rising flat price and freight volatility are increasing inventory and pricing risks for refiners. We forecast global runs will rise by 0.75 mb/d y/y in H1 26, supported by elevated hedging and low spring maintenance.

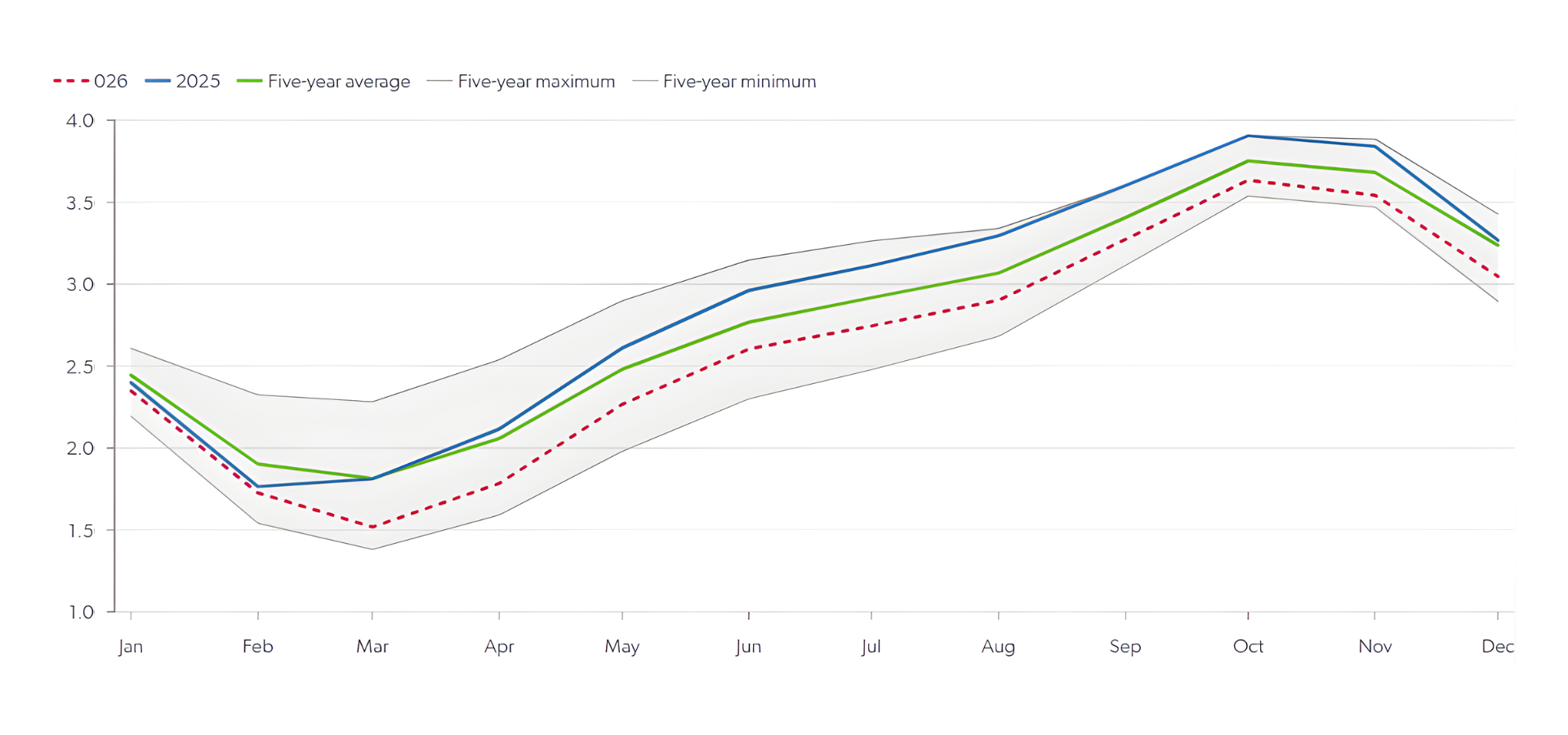

Europe Gas

We remain bullish on TTF Mar-26 and Q2-26 contracts, as

European storage inventories are well below the five-year average. The bal-winter risks are skewed to the upside, with storage likely to be challenged by any late-winter cold snap. Europe would need to add 63–65 bcm to reach what we see as the minimum required inventory levels to ensure winter supply security.

North America Gas

Forecasts for the Lower 48 show a break in the cold snap, with heating degree days expected to fall below the 10-year average from mid-February.

The Henry Hub prompt contract had its sharpest decline in 30 years after a warm trend emerged, and we continue to forecast below-average storage carryouts for end-March and end-October 2026.

Global LNG

JKM–TTF spreads have narrowed as freight rates collapse and supply to east-of-Suez markets increases.

A significant y/y boost to baseload east-of-Suez supply is expected this year from the full ramp-up of LNG Canada, reducing the need for West African cargoes and shifting more US spot cargoes towards Asia.

Europe diesel inventories, mb

Source: OilX, Energy Aspects

Geopolitics

If diplomacy with Iran fails, President Trump may pursue military strikes on internal security, nuclear, or missile sites—targets favoured by Israel—or opt for non-kinetic measures such as cyberattacks, covert support and economic pressure. He could also tighten enforcement of secondary sanctions on Iranian crude buyers or impose further tariffs (his preferred tool).

Two days of trilateral Russia–Ukraine–US talks in Abu Dhabi ended without a breakthrough, with discussions set to resume in the coming weeks.

For markets, the main takeaway is a reduced likelihood of any rapid shift in sanctions policy.

Marco

The consensus view that global growth was set to accelerate in 2026 appears to be unravelling. Inflation risks remain, as companies likely front-loaded tariff-driven price increases at the start of the year.

The US labour market is showing growing signs of weakness, with ADP data indicating that the subdued hiring and firing trend in late 2025 persisted into January. Increasing announced layoffs and declining job openings suggest further deterioration is likely.

This article was first published on LinkedIn. For a deeper dive into this topic and to stay updated with our latest insights,

you can access the full newsletter here.