Sell the rumour, sell the news: Energy markets in the red as fundamentals weaken

December 17, 2025

Crude prices face renewed pressure as markets anticipate heavy Q1 26 stockbuilds, with curves poised to shift into contango. Gasoline remains tight, with global balances set to draw from Q2 26, while prompt diesel stays weak but could find support from the EU’s looming “refining loophole” ban. Global refining capacity is stretched, leaving little room to absorb shocks, and any extra supply of clean products will depend on new projects or fewer outages. Meanwhile, Fed Chair Powell’s softer tone has buoyed risk assets, but this week’s US labour and inflation data could quickly dampen the usual year-end bullish sentiment.

In gas, we hold a slightly bullish view on TTF prices for 2026, especially for Q1 26 delivery, as late-winter stock-out risks build. We remain bearish on JKM–TTF spreads for 2026, with new LNG supply outpacing demand growth, and also bearish on Henry Hub 2026 prices, as we expect production growth to easily offset the structural rise in demand from LNG export facilities.

Crude Oil

Liquidity is likely to remain thin over the coming weeks, and prices may drift lower unless major geopolitical outages disrupt the market. Ukraine peace talks are a major volatility driver. We think an imminent deal is unlikely, but the window for one has opened.

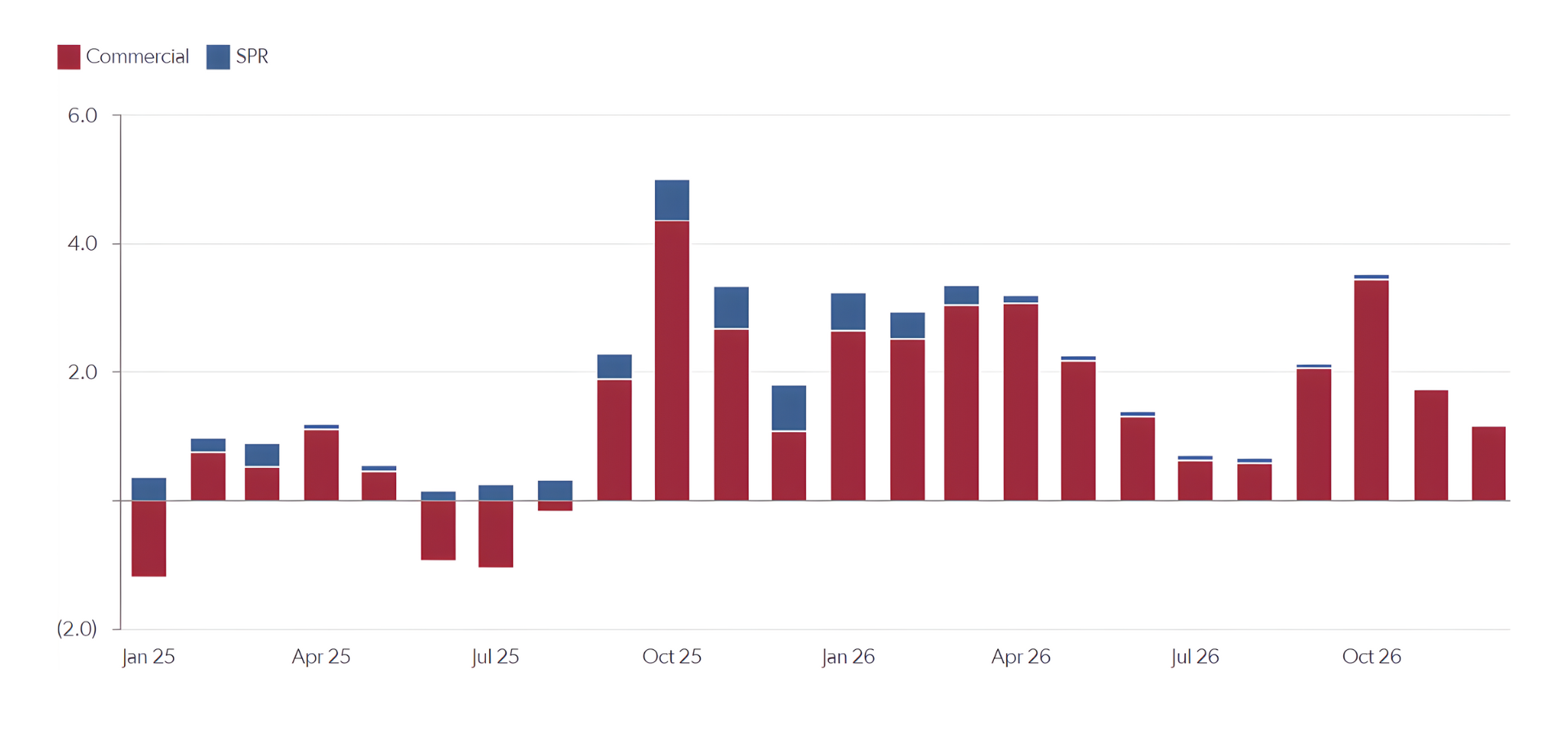

Chinese SPR buying has provided support for prices this year, and another buying round is possible in 2026, with few capacity constraints. Overall, global demand fears likely peaked in Q2 25 after “Liberation Day”, when US President Donald Trump’s tariff threats briefly unsettled markets. We forecast global liquids demand to rise by 1.2 mb/d y/y in 2026, up from 0.8 mb/d growth in 2025, despite ongoing macro and policy uncertainty.

Global non-OPEC crude production is set to grow by 0.84 mb/d in 2026, but this outlook is highly price-sensitive. If Brent prices drop into the $50s for more than six months, we expect a y/y decline of 0.8 mb/d in H2 26, led by the US. OPEC+ will also play a key role in 2026—if the group continues to draw down spare capacity, it will support prices further out on the curve.

Oil Products

Gasoline markets will remain tight over winter 2025–26, with global demand rising and stockdraws expected through summer. Any relief from Nigeria’s Dangote refinery is likely to be limited. Diesel remains weak at the prompt, but the EU’s “refining loophole” ban could boost cracks as Europe seeks alternative supply. Atlantic basin inventories are tight, and any supply shock or cold weather could amplify price moves.

Figure 2: Brent 3-2-1 crack, $/bbl - Source: Bloomberg, Energy Aspects

Refining

Global refining capacity is stretched, with utilisation near maximum and limited flexibility to absorb major supply disruptions in 2026. Any increase in product supply will depend on new capacity additions or a return to normal after unplanned maintenance. Most new capacity is due to come online in H2 26, which should ease margins, but delays could keep margins elevated for longer.

Europe Gas

We are slightly bullish on TTF prices for Q1 26, with stock-out risks rising as underground inventories draw down into late winter. Milder weather has softened demand recently, but any cold snap could quickly tighten balances. Market risks include LNG project outages, Russian attacks on Ukrainian infrastructure, and the potential for higher Arctic LNG 2 exports.

North America Gas

A brief cold snap in early December pushed Henry Hub above $5/MMBtu for the first time in nearly three years, but forecasts now look milder. We remain bearish on Henry Hub in 2026, as we believe production growth, especially from the Permian and Haynesville, should easily offset rising LNG demand.

Global LNG

We remain bearish on JKM–TTF spreads for 2026, as only marginal West African cargoes are needed, with new supply from LNG Canada and Pluto Train 2 limiting Atlantic basin flows to Asia. Freight market pressures are easing, with rates expected to settle lower into next year.

Long-term and Transition

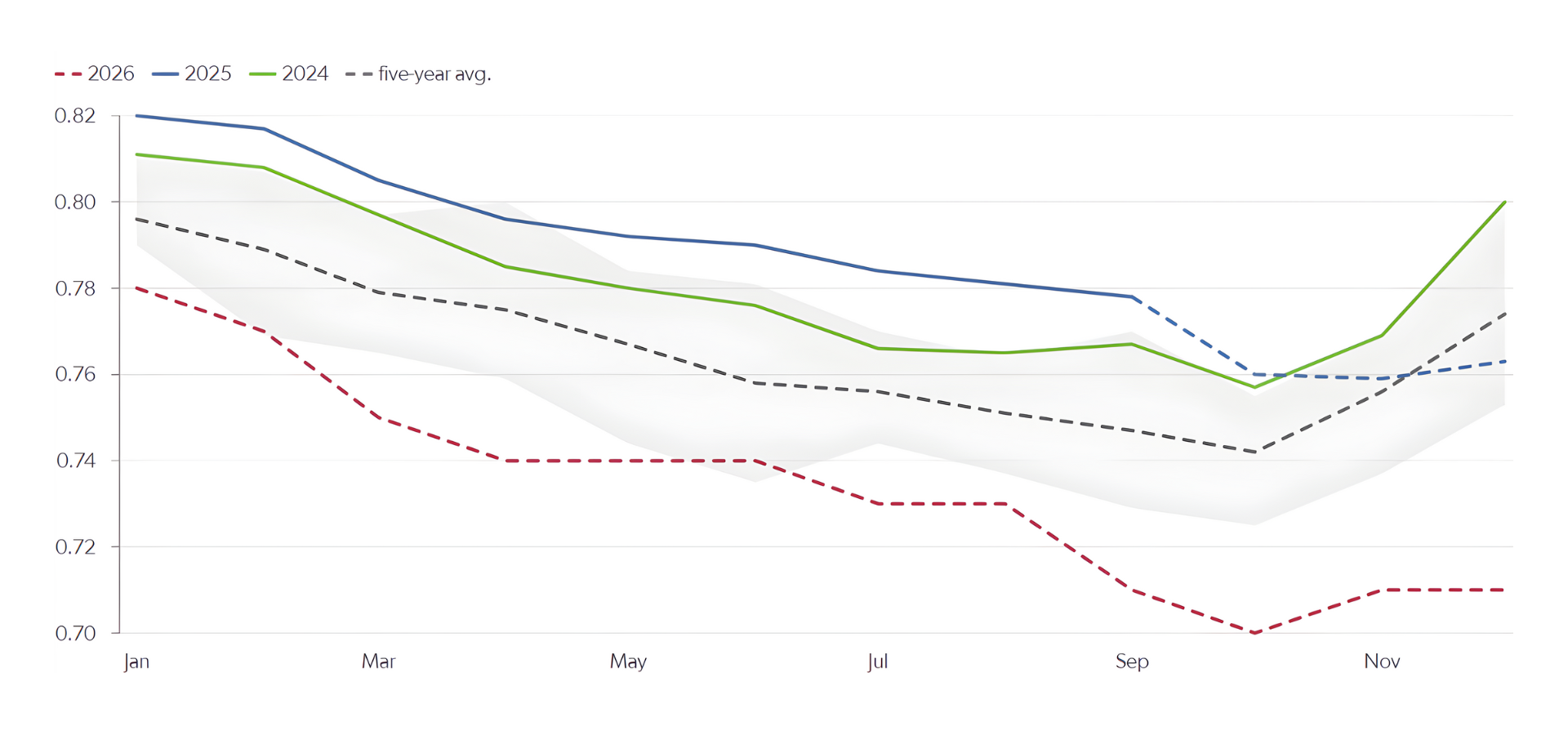

The expiry of the US EV tax credit has sharply reduced EV sales, lifting US gasoline demand forecasts through 2030. Stronger US chemicals demand has also boosted liquids demand, while robust EV sales in China and higher GDP growth are supporting global chemical feedstock demand. Our global liquids demand peak is now expected at 110.2 mb/d in 2033.

Geopolitics

Geopolitical risks remain two-sided, with Russia–Ukraine, Israel–Iran and Venezuela likely to dominate headlines in 2026. Trump’s unpredictable foreign policy, ongoing sanctions and unresolved conflicts will keep volatility elevated.

The trajectory of the Russia–Ukraine crisis will have the greatest impact on oil markets next year. Trump’s approach so far has involved a reluctant tightening of oil sanctions on Russia and a loosening of restrictions on Ukraine’s attacks on Russian energy infrastructure. He could escalate sanctions and support for Ukraine, or pressure Kyiv into a deal, and each scenario would have vastly different implications for oil markets.

Marco

Fed Chair Powell’s less hawkish tone has lifted risk assets, but this week’s US labour (NFP) and inflation (CPI) data could quickly reverse sentiment. The US labour market remains a key risk for 2026, with layoffs rising and hiring at pandemic-level lows. Another risk to watch is the surge in AI investment costs, with credit markets signalling concern over mounting debt in the tech sector.