Neste returns to Oregon in response to soaring CFP credit prices

By downloading this report, you'll discover:

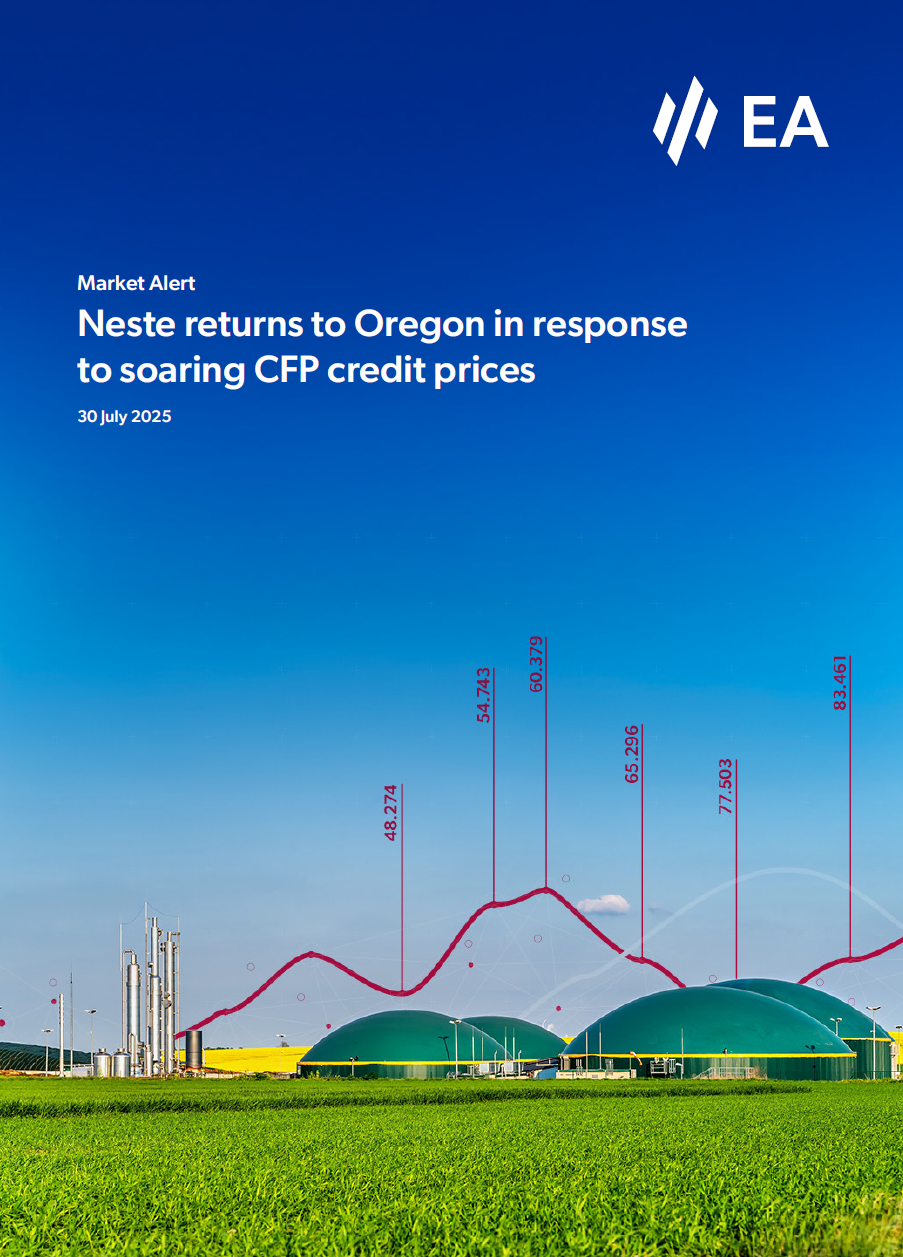

- The substantial price differential driving unexpected changes in renewable diesel shipment patterns.

- How a major supplier has redirected volumes to Oregon after months of absence.

- Our revised blend-rate forecasts based on emerging supply responses.

- The strategic positioning of credit holders amid tightening market conditions.

- Potential price movement scenarios for Q3 2025 and beyond.

Download report

Please fill in your contact details to access the full insight.