Fade expectations: Products prices surge as market fades Russian crude risks

November 11, 2025

Products, and diesel in particular, have been the biggest mover this week, with Atlantic basin diesel cracks and spreads surging on low inventories, refinery outages and heightened geopolitical risks. Gasoline prices also hit multi-year highs, supported by US inventory draws and upcoming maintenance.

In contrast, crude prices remain under pressure, driven by market apathy towards Russian sanctions. While traders expect workarounds, stricter US enforcement could disrupt up to 1.5 mb/d of Russian crude exports.

On the macro front, energy is the only sector in positive territory as equity markets weaken. We are bullish on TTF prices in gas as Europe enters winter with below-average stocks, while the rally in US Henry Hub prices looks overdone amid strong production.

Crude Oil

Crude has remained stuck in its downtrend since late October as markets increasingly fade the impact of US sanctions on Russia. We maintain the market is underestimating sanction risks, given recent signals from the US government including its rejection of Gunvor’s bid for Lukoil’s international assets.

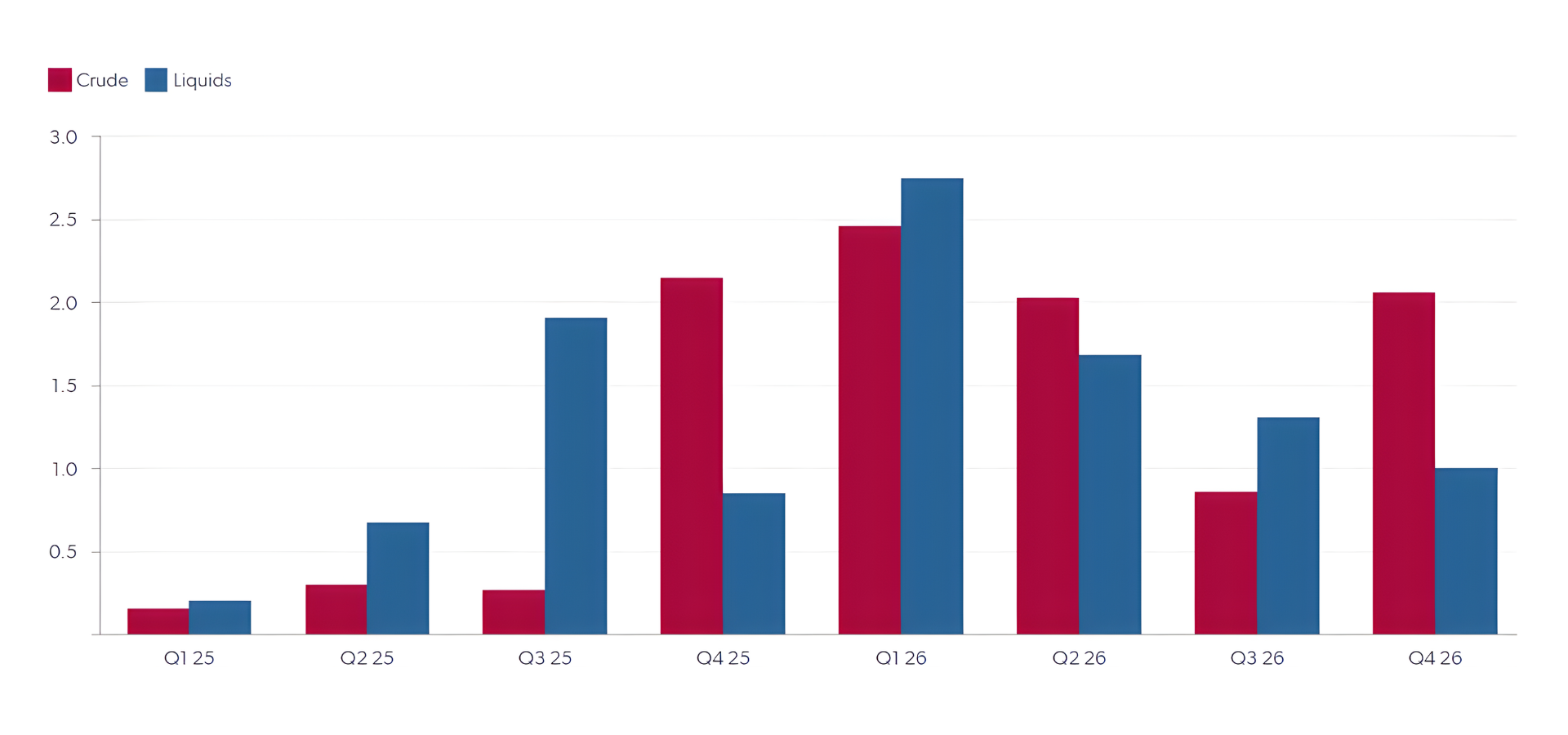

We expect the largest global commercial crude stockbuilds in Q1 26. Prices could fall further if Russian crude held on water is released early next year, unless US sanctions are enforced.

Figure 1: EA Crude and liquids stock changes, mb/d - Source: Energy Aspects

Oil Products

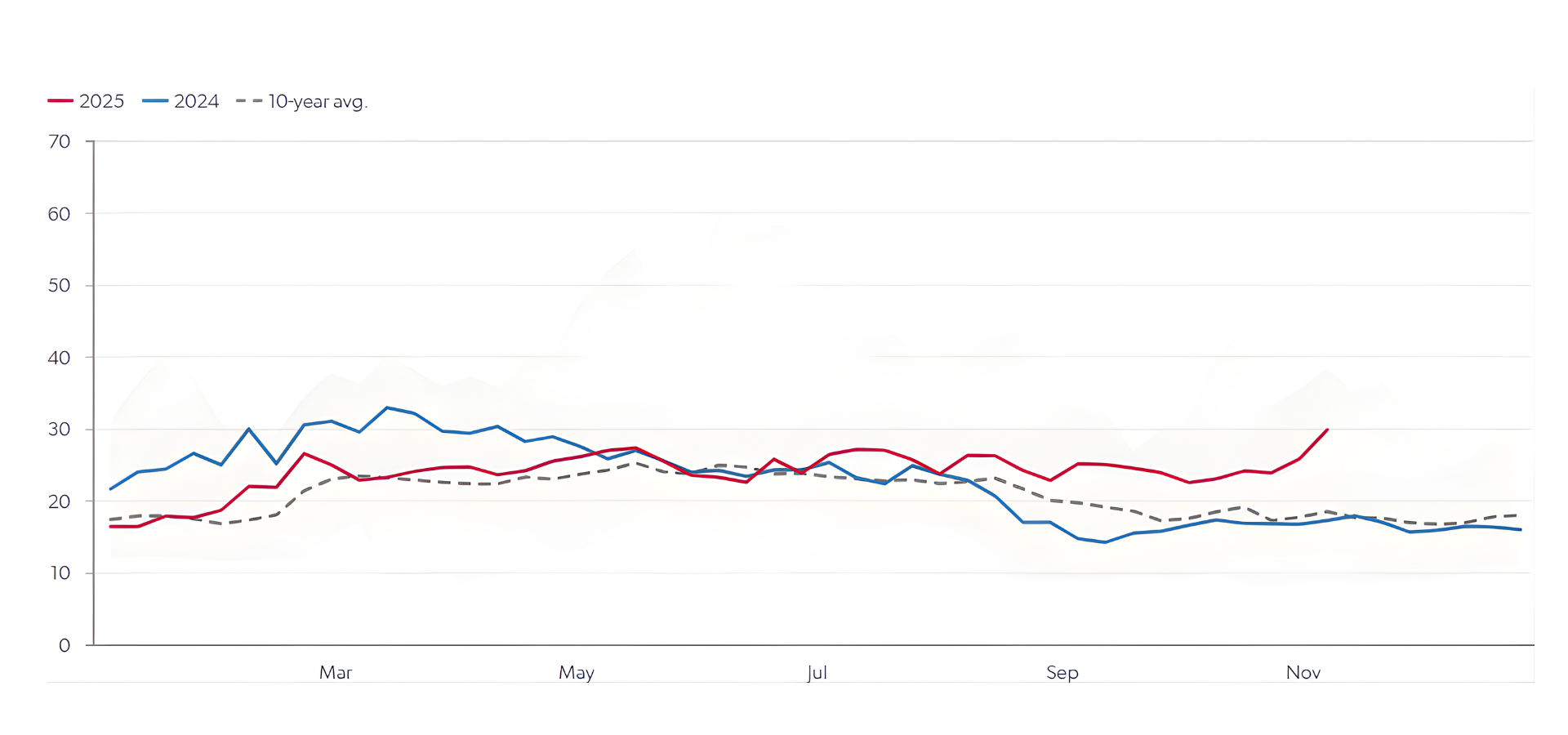

Product markets are showing renewed strength, led by a sharp rally in diesel cracks on low inventories and mounting uncertainty around Russian exports. Fresh highs were also catalysed by news that Dangote will be offline from December for two months. While Dangote’s return will eventually weigh on European summer gasoline, we expect market tightness to persist until at least May 2026.

Figure 2: Brent 3-2-1 crack, $/bbl - Source: Bloomberg, Energy Aspects

Refining

Product markets are showing renewed strength, led by a sharp rally in diesel cracks on low inventories and mounting uncertainty around Russian exports. Fresh highs were also catalysed by news that Dangote will be offline from December for two months. While Dangote’s return will eventually weigh on European summer gasoline, we expect market tightness to persist until at least May 2026.

Europe Gas

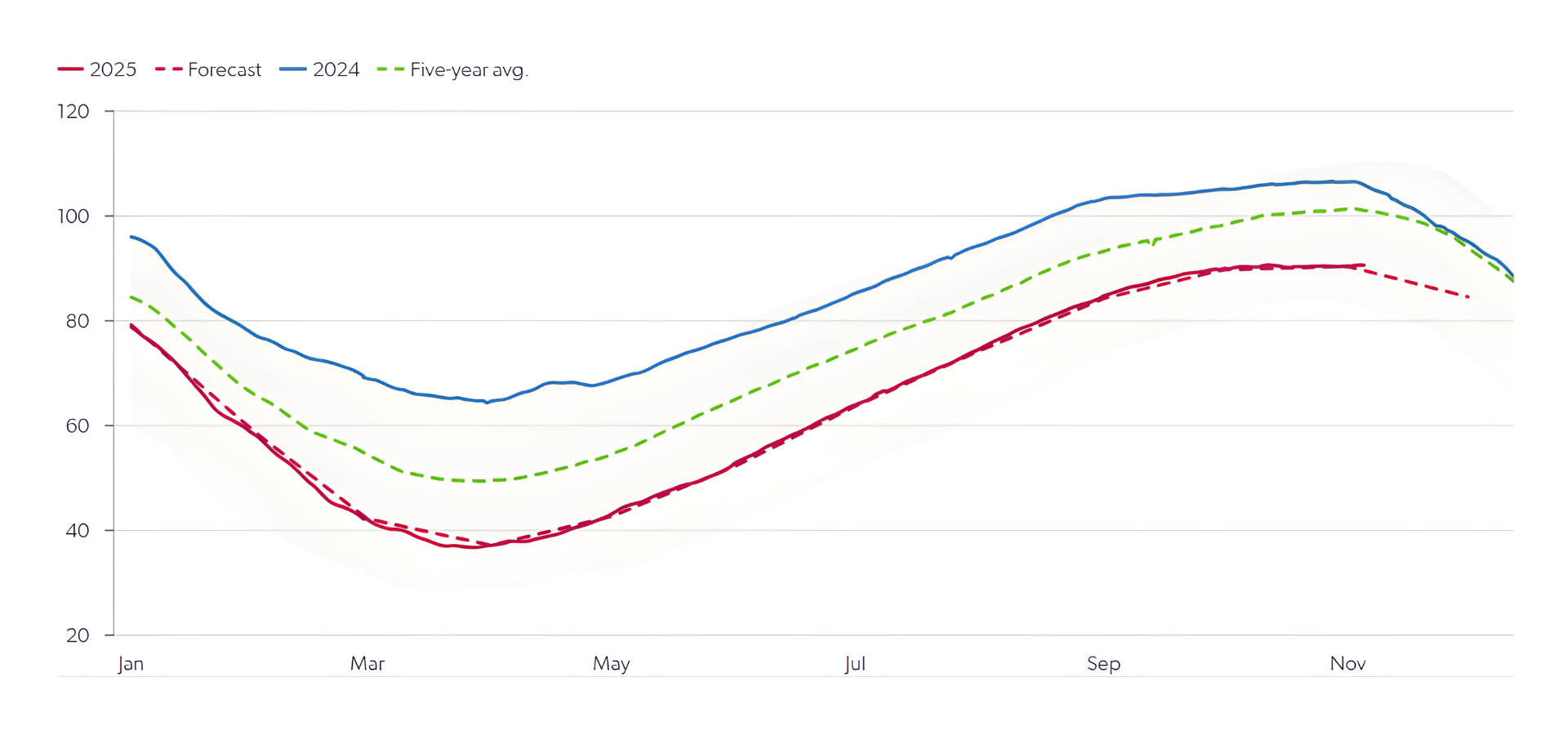

European gas balances are tightening, with storage starting winter at 90 bcm, below last year and the five-year average. We see TTF prices sitting higher than the market curve to moderate winter demand and attract Atlantic basin LNG, supporting inventory recovery into end-October 2026.

Figure 3: European storage fill, bcm - Source: GIE, Energy Aspects

North America Gas

US gas prices have rallied w/w, but the move appears overdone given rising production and moderate weather forecasts. Storage carryout for end-March 2026 has been revised down, but there is limited risk of shortages. Feedgas flows are set to tighten balances as new LNG projects ramp up.

Global LNG

We are bearish on JKM–TTF spreads for bal-winter, as only marginal West African cargoes are likely needed and Asian LNG inventories remain high. But we remain bullish on outright JKM prices, supported by our positive TTF outlook, with higher prices needed to curb European demand and attract flexible LNG.

Geopolitics

The Trump administration is increasing pressure on Maduro, although US policy limits persist. Traders are keeping an eye on the potential impact of a regime change on Venezuela’s oil prospects, but we believe that talking about a rapid rebound in oil output is premature.

Marco

Financial markets are showing increased caution amid limited US economic data and concerns over growth. Global manufacturing PMIs suggest contraction is easing, but order backlogs and imports in the US have declined, pointing to ongoing challenges.