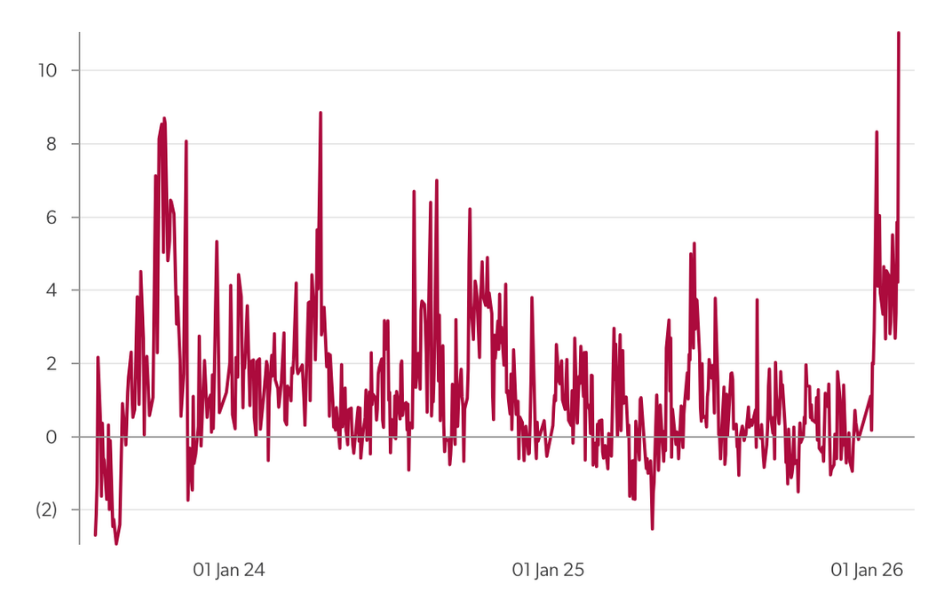

Energy Aspects' crude oil geopolitical risk index

13 February 2026

AI-driven analysis of EA research and financial market volatility

Geopolitics has firmly taken centre stage since the start of the year, with developments impacting the oil market from multiple directions. As Richard Bronze, Head of Geopolitics at Energy Aspects, highlighted at our IE Week reception, Energy Aspects' crude oil geopolitical risk index is now registering the longest sustained period of elevated levels seen in several years.

There are two key drivers behind this trend. First, the sheer number of concurrent events, from Iran to Venezuela, means the market is constantly having to assess and price in a range of scenarios. Second, and most importantly, unlike previous periods where geopolitical risk was largely about potential tail risks, we are now witnessing real supply disruptions. These include the CPC outage in Kazakhstan, supply losses from Venezuelan blockades, a significant reduction in light sweet crude availability, and the accumulation of sanctioned Russian barrels.

This is no longer just about potential tail risks, it is a story of concrete supply disruptions directly impacting the crude oil market.

What is the EA crude oil geopolitical risk index?

The EA crude oil geopolitical risk index is based on sentiment from EA’s crude research combined with Brent options data to provide a reliable, oil-specific measure of geopolitical risk, designed to provide real-time, actionable insights for crude oil markets. Unlike broader, lagging indices, the EA index is built from the ground up to capture the unique dynamics and tail risks that geopolitical events pose to oil supply, pricing and volatility.

EA crude geopolitical risk index

Source: Energy Aspects

EA Live: 'Our crude geopolitical risk index is at multiyear highs on US–Iran tensions as prompt options skew strengthens'

9 Feb 2026, 10:33

How is it derived?

By blending AI-driven lexicon analysis of EA content with options market positioning metrics such as put-call skew and call-to-put volumes, it captures both fundamental developments and forward-looking trader behaviour, making it a robust and timely indicator for market participants.

A key innovation is our use of a large language model (LLM) prompt to systematically assess whether news and research content explicitly connect geopolitical events to oil markets or supply. This AI-driven process ensures only relevant, current, and imminent risks are captured, filtering out noise and general market sentiment unrelated to oil-specific geopolitical threats.

Why is it better than previous indices?

Traditional indices, such as the Caldara and Iacoviello global geopolitical risk index, often lag market movements, are published infrequently, and struggle to explain prompt Brent futures price volatility during oil-specific geopolitical events. In contrast, the EA index delivers clearer, more persistent signals, demonstrating a statistically significant one-day lead over traditional indices and around three days of persistence, which is invaluable for near-term volatility analysis and prompt Brent risk management. Our index has already identified multiple major geopolitical events affecting oil markets since 2023, with sharper and more actionable signals than previous benchmarks.

Download the full insight

Ready to dive deeper? Download the full insight that explains our AI-driven approach to assessing geopolitical risk that directly impacts oil markets.