Waha delivered cash price forecast: Permian gas pipeline maintenance and 2026 outlook

18 February 2026

In early 2025, the

North American gas market was bracing for a turbulent spring.

The Permian Basin, a key driver of US gas supply, faced a wave of scheduled pipeline maintenance.

Market participants were hopeful that new capacity, particularly from the Matterhorn Express pipeline, would ease constraints and support Waha prices. However, the risk of persistent bottlenecks and negative pricing loomed large, especially as maintenance season approached. The dynamics presented last spring provide a clear indicator of the challenges that Waha prices and Permian production continue to face in early 2026.

EA Live market update – 7 April 2025

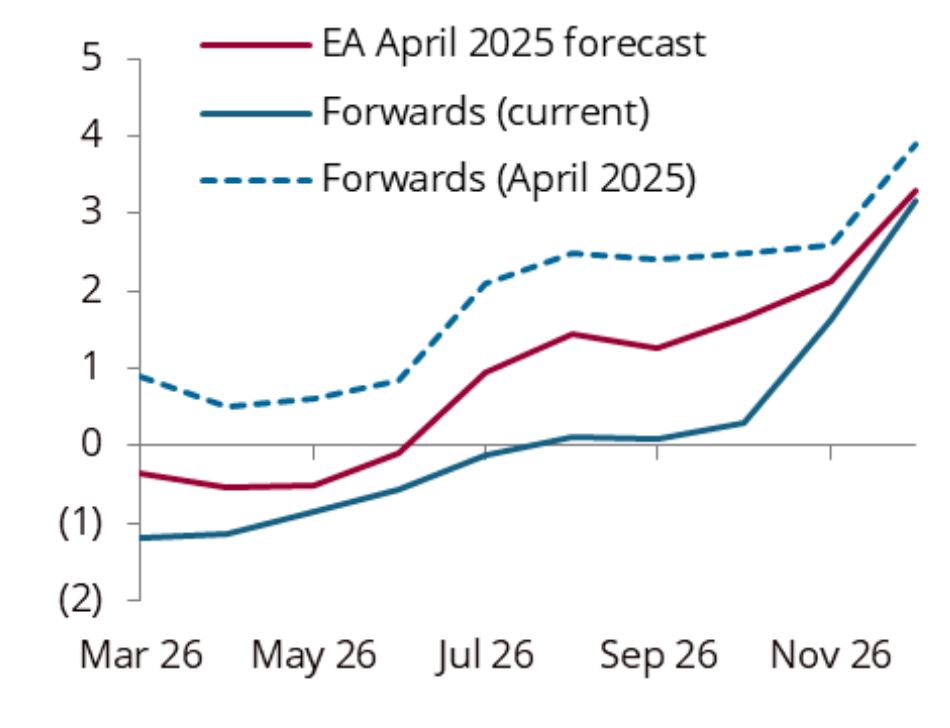

On 7 April 2025, Energy Aspects issued a clear warning: “Permian pipeline maintenance scheduled to peak in late April will push Waha to negative delivered prices this month.” Our analysis highlighted that, despite the addition of new pipeline capacity, the Matterhorn Express was already flowing full, and further maintenance outages would depress Permian gas production to 20 bcf/d in Q2 25. We forecast that Waha prices would average -$0.40/MMBtu in April and remain near or below zero through peak summer, with the risk of even deeper negative pricing in H1 26.

We also noted: “Permian gas capacity will remain constrained until H2 26’s new pipelines, with deeply negative Waha prices expected in Q2 26.” Our team flagged that the next meaningful relief would not arrive until mid-2026, when new projects such as the Gulf Coast Express expansion and the greenfield Hugh Brinson and Blackcomb pipelines are scheduled to come online.

????????

Source: Energy Aspects

EA Live:'Our crude geopolitical risk index is at multiyear highs on US–Iran tensions as prompt options skew strengthens'

9 Feb 2026, 10:33

Proprietary analysis and real-time monitoring

Our call was underpinned by a rigorous assessment of scheduled maintenance across all major Permian systems, including Permian Highway, NGPL, EPNG, Transwestern, GCX, and Northern Natural. We identified that capacity reductions would top 2 bcf/d in late April, coinciding with compression inspections and ongoing restrictions. Real-time monitoring of pipeline flows, combined with direct conversations with producers and operators, confirmed that the Matterhorn Express was already near full capacity, leaving no room for additional gas egress. Our analysis of construction updates for pipelines still in-development also pointed to a lack of long-term relief to this congestion until mid-2026.

We also leveraged our proprietary modelling to forecast the impact of these constraints on Permian production, NGL output, and Waha pricing. Our analysis anticipated that negative Waha prices would drive higher ethane recovery and slow NGL production growth, while also creating a take-or-pay dynamic that would support WTI-Midland spot differentials.

Market moves in line with EA’s forecast

Events unfolded exactly as predicted. Maintenance outages peaked in late April, pushing Waha delivered prices into negative territory. Waha dropped to negative delivered cash price over 18-21 April during the peak of maintenance, and again from 17-27 May. The Matterhorn Express pipeline remained full, confirming our view that new capacity would be quickly absorbed. Permian production declined to 20.2 bcf/d, with further downside risk through May. While the forward curve at the time indicated Waha delivered prices of close to $0.75/MMBtu for Q2 26, those prices have since dropped into negative territory, in line with our long-held forecast and validating our forward-looking call from 2025.

Why this matters

Clients who acted on our analysis were able to manage risk, optimise trading strategies, and capture value as Waha prices weakened and pipeline constraints persisted. Our timely updates provided a clear signal amid market noise, helping clients anticipate both the depth and duration of negative pricing.

EA’s unique value

Events unfolded exactly as predicted. Maintenance outages peaked in late April, pushing Waha delivered prices into negative territory. Waha dropped to negative delivered cash price over 18-21 April during the peak of maintenance, and again from 17-27 May. The Matterhorn Express pipeline remained full, confirming our view that new capacity would be quickly absorbed. Permian production declined to 20.2 bcf/d, with further downside risk through May. While the forward curve at the time indicated Waha delivered prices of close to $0.75/MMBtu for Q2 26, those prices have since dropped into negative territory, in line with our long-held forecast and validating our forward-looking call from 2025.

Stay ahead with Energy Aspects

For a deeper dive into our North American gas market analysis and to access the full report, request a trial or subscribe to our research services.

This insight was originally published for EA Clients on 7 April 2025.