Comprehensive Crude Oil market analysis

Trade, invest, and hedge with our industry-leading oil market data and intelligence

In today’s dynamic oil markets, staying ahead of emerging trends is crucial. Energy Aspects' comprehensive crude oil service provides in-depth coverage of global supply, demand, trade, inventory, and pricing trends, making it essential for anyone navigating these complex markets.

2026 Oil Market Outlook

Live webinar

29 January, 15:00 GMT (10:00 EST)

Join us for our 2026 Oil Market Outlook webinar, where you will hear our latest views on global crude and products markets.

Gain deeper knowledge of the global crude oil markets

Empower your trading and hedging decisions with our comprehensive analysis, proprietary datasets, and insights from leading industry experts.

Our industry-leading Crude Oil market analysis empowers you to make informed trading, hedging, and commercial decisions amid rapidly changing conditions. With proprietary datasets, timely reports, and direct access to analysts, you will always stay ahead of emerging crude oil trends. By leveraging extensive market networks and insights from leading industry experts, we help you anticipate trends before they materialise.

Benefits of Energy Aspects’ Crude Oil market analysis

Gain strategic insights with our data-driven analysis, extensive market coverage, and accurate forecasts, supported by expert knowledge and 24/7 access to specialists.

Data-driven insights

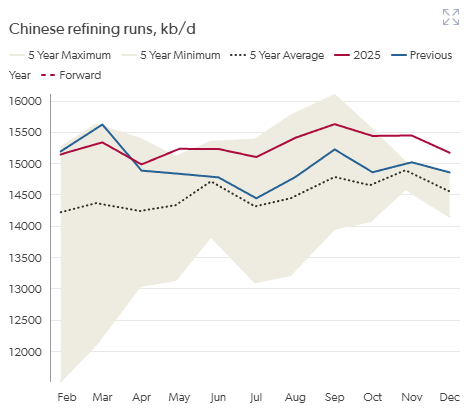

Our data-driven analysis of crude oil supply and demand, combined with extensive knowledge of the geopolitical and macroeconomic landscape, delivers robust insights to guide your strategic positioning.

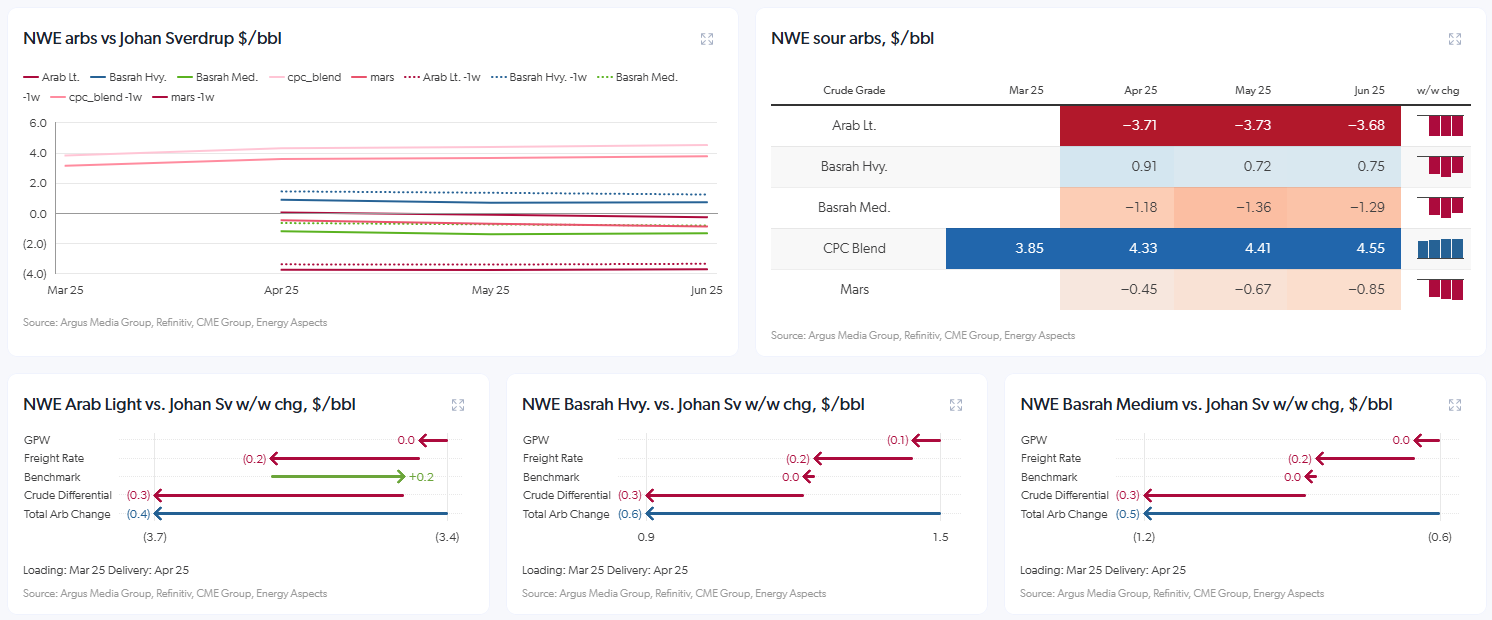

Our service provides deep dives into the latest developments in both the Atlantic basin (Brent) and East of Suez (Dubai) crude markets, including detailed Brent oil market analysis. We examine regional trade flows and pricing to help clients identify valuable trading, hedging, and arbitrage opportunities.

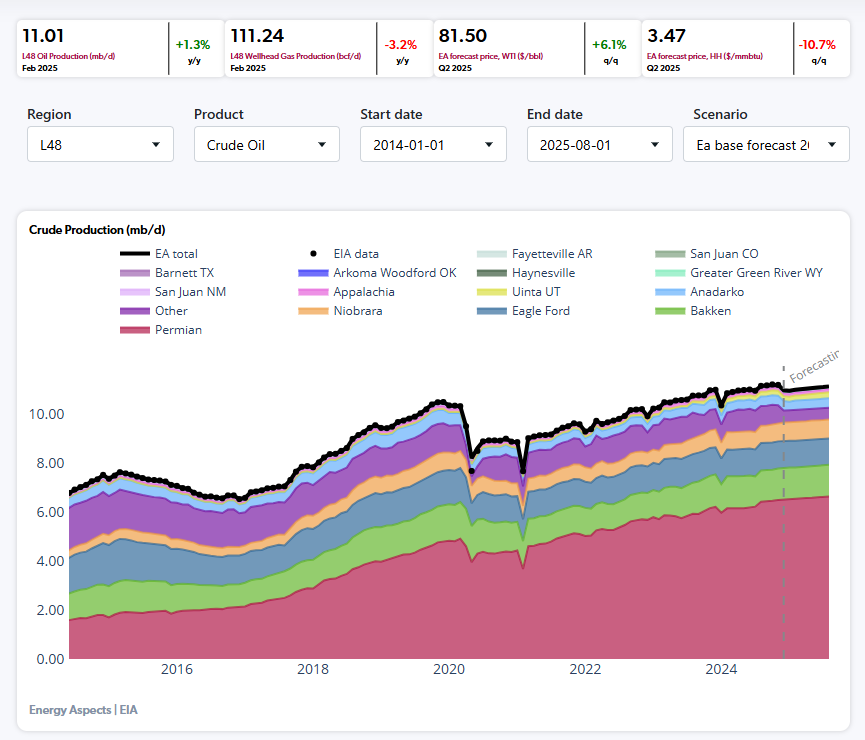

Extensive market coverage

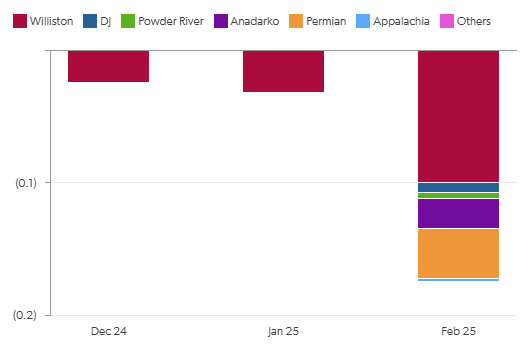

We also offer extensive coverage of the North American oil market, analysing the continent’s sweet (WTI) and sour (Mars) crude fundamentals. This includes detailed updates from the Gulf of Mexico and Cushing to the Bakken and Canada. We regularly explore trends in drilling activity, production, trade flows, and refining, while analysing movements in commercial and strategic storage levels.

Accurate forecasts

Our crude oil market analysis service saves you time and energy by providing realistic estimates of international market supply, demand, and pricing. Energy Aspects' ability to collect, integrate, and analyse extensive datasets allows us to deliver accurate, forward-looking crude oil supply and demand balances and oil price forecasts, enabling clients to identify profitable trades or hedge risks.

Expert support

The supply and demand models that underpin Energy Aspects' crude oil analysis are based on proprietary datasets developed and refined over our 10-year history. Energy Aspects' supply models and forecasts are supported by expert knowledge of the upstream oil industry, while our demand models are fully integrated with refining, oil products, and LPG/NGLs services to ensure complete coverage of global liquids demand.

24/7 access

You can also access Energy Aspects' team of crude oil specialists, available around the clock to respond to questions about our analysis or to act as a sounding board for your independent findings.

Our Crude Oil coverage

Access leading energy and commodities market data and analysis.

Short and long-form research:

Stay informed with both short and long-form research. Weekly Perspectives articles deep-dive into current market movements and trends, while our short-from alerts and insights arrive quickly to keep you ahead of the curve. You will also receive monthly and quarterly updates and outlooks articles helping shape your trading strategies.

EA Live crude feed:

With our

live analysis feed receive commentary throughout the day via desktop or mobile app, providing immediate insights on significant market movements directly from our expert analysts.

Crude oil data:

Visualise complex data with our dashboards for Weekly oil rigs, Sour arbs, Sweet arbs, Canada oil, US pipeline maps and specific China dashboard. Also leverage our daily and historical data in Python JSON or CSV/XLSX formats for back-testing and analysis.

Data Explorer:

Our

data visualisation tool enables quick and intuitive visualisation of historical crude oil data with no coding required, allowing you to easily chart, save to your library, and generate images to share with colleagues.