TankWatch® Cushing by Energy Aspects

Industry leading crude storage intelligence

TankWatch uses the highest resolution imagery combined with specially developed algorithms to measure crude storage at unparalleled levels of frequency and accuracy.

TankWatch offers unique insights into crude inventories and reserves, tailored for the needs of traders and analysts.

At Energy Aspects, we are constantly working to expand our service and enhance our capabilities - delivering even deeper insights and broader coverage to better support your decisions in a rapidly evolving market.

TankWatch Cushing

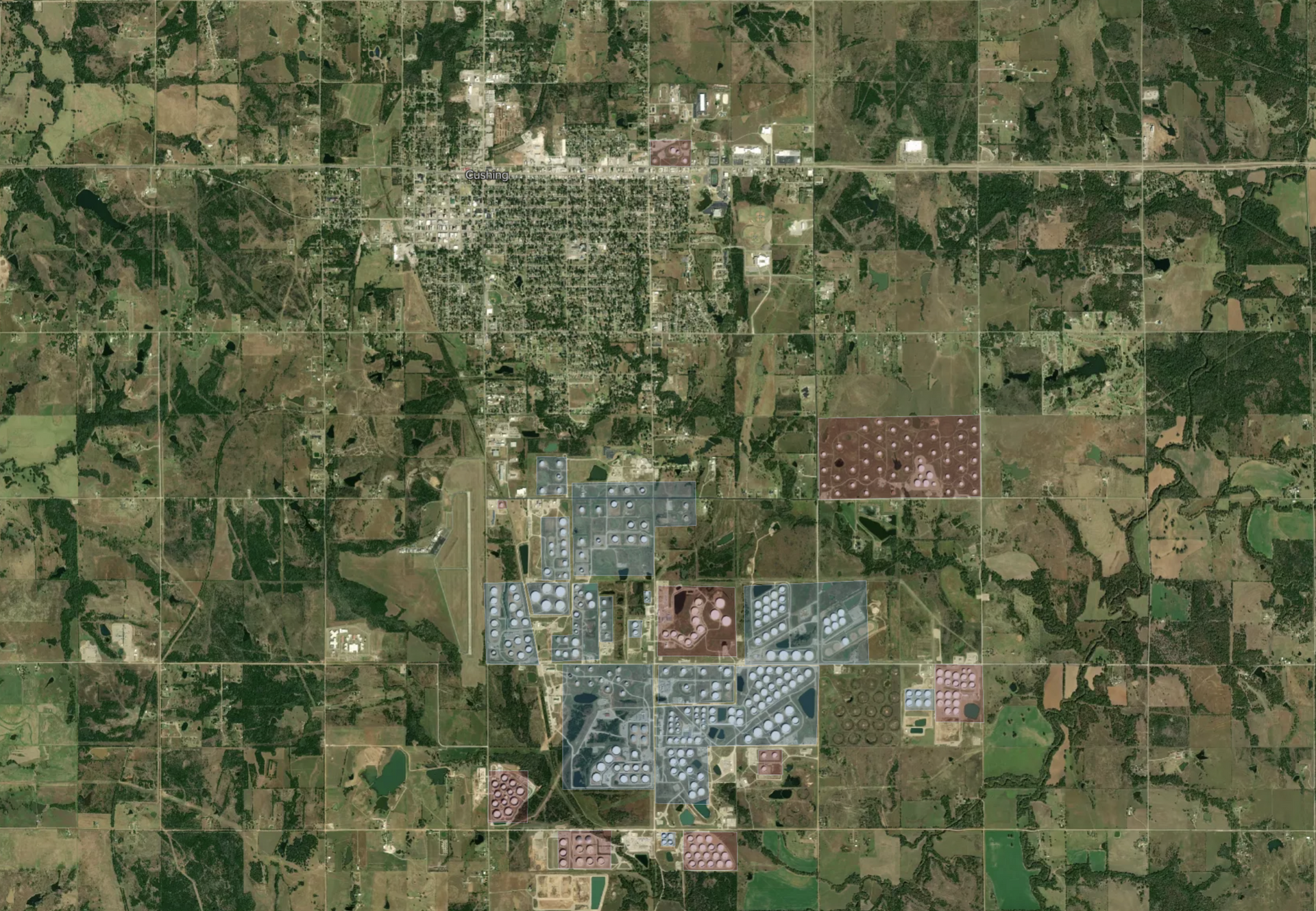

Cushing, Oklahoma, is the key hub for NYMEX Crude Oil futures. Known as The Pipeline Crossroads of the World, it has a 90-million-barrel storage capacity and transports over 6.5 million barrels daily. This infrastructure supports WTI’s status as a global benchmark, crucial as US oil production continues to rise.

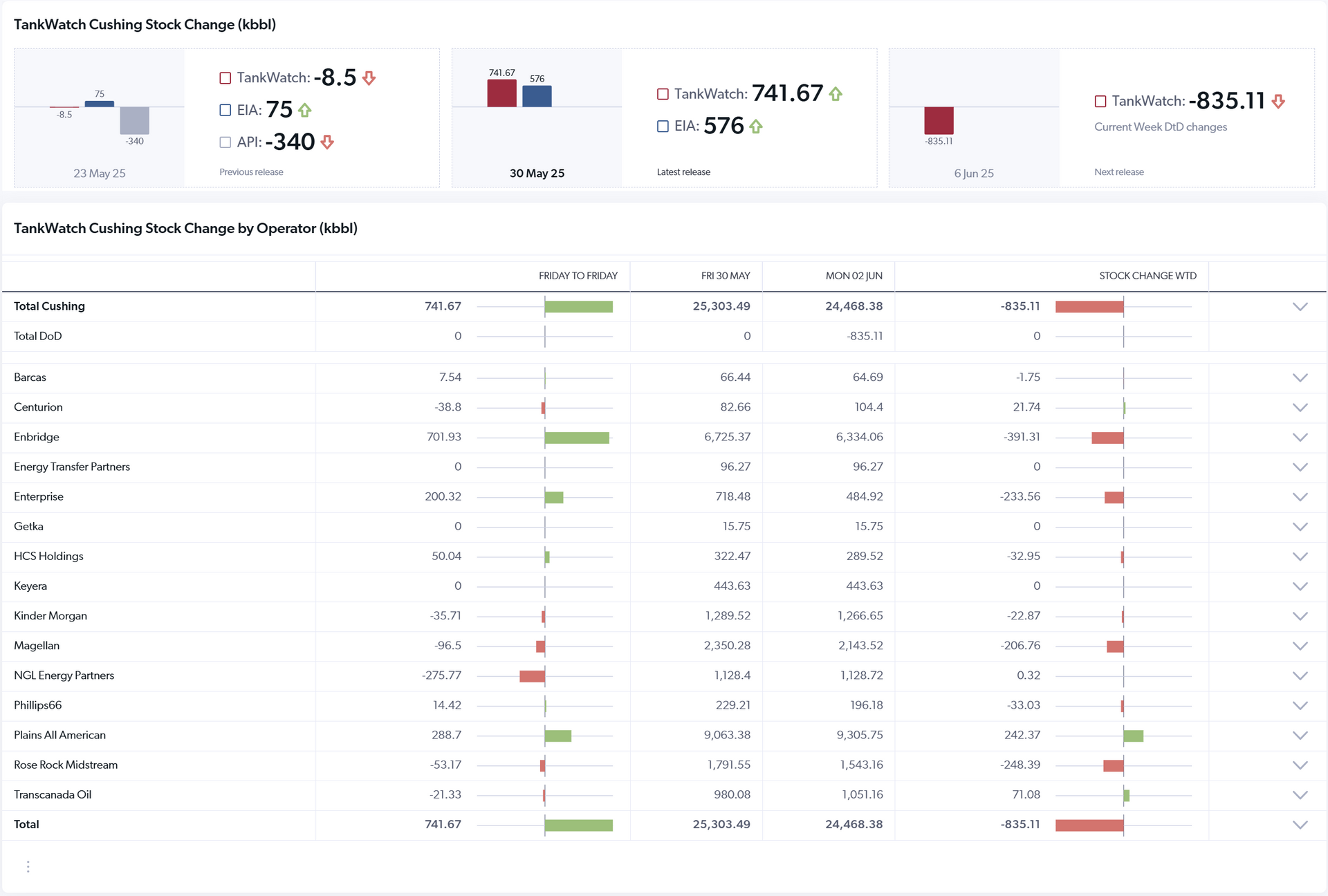

TankWatch by Energy Aspects leads the market by delivering the most frequent per-tank, per-operator Cushing oil inventory data, providing first-to-market insights into daily changes in WTI stocks. Our continuous monitoring of the Cushing, Oklahoma oil storage site allows for detailed measurements and highly accurate insights into potential supply and demand shifts.

Data on tank inventories at the individual operator level serves as a valuable indicator of the crude oil composition at Cushing. By acting as a proxy for the types of crudes available, these inventories provide insight into which crudes are readily accessible for DSW blending (physical WTI NYMEX). This information is crucial for forming views on the future liquidity of physical deliverables against WTI NYMEX

Oil traders and analysts leverage this valuable intelligence from the Cushing storage hub to make more informed and agile WTI trading decisions.

Gain strategic advantage

TankWatch delivers real-time asset intelligence, drives data-backed futures strategies, quantifies market impacts, and exposes arbitrage opportunities for sharper trading decisions.

Asset monitoring

Monitor storage levels at purchased or leased trader assets.

Data-backed futures strategies

Develop event-driven WTI futures strategy and apply it to other securities that correlate with crude futures.

Comprehensive impact analysis

Gain insights into the effects of supply/demand fluctuations and economic impacts.

Identify arbitrage opportunities

Identify and capitalise on cash arbitrage opportunities.

High-impact insights, delivered

From industry-leading accuracy to rapid reporting and historic depth, TankWatch equips your team with the data edge needed for confident strategic decisions.

Highest accuracy:

Achieves the highest accuracy compared to EIA figures.

Fast delivery of measurements:

Delivers measurements within 24 hours of data capture.

Consistent data reporting:

Delivers data reports four times a week.

Extensive historical data:

In constant operation since 2018, the service provides access to extensive historic back-test data.