OPEC+ spare capacity

Country-by-country historic and forecast data for each producer in the OPEC+ group

The rapid pace at which the oil market is rebalancing means attention once again is turning to the amount of spare production capacity available to respond to tightening fundamentals. To help investors and decision-makers explore this critical question, we have recently added OPEC+ spare capacity estimates to our crude oil data service.

We now provide country-by-country historic and forecast data for each producer in the OPEC+ group, updated monthly. Our figures go into highly granular detail, taking into account factors such as sanctions, geopolitical disruptions and technical outages to determine how much of a given country’s nominal unused production capacity is actually available to bring online.

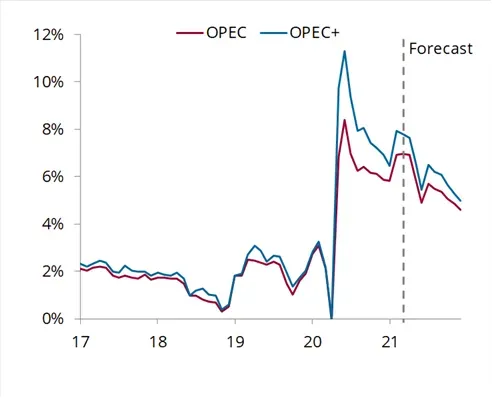

Current volumes of spare capacity remain high, which is unsurprising given OPEC+ production quotas remain in place and as Saudi Arabia is voluntarily cutting an additional 1 mb/d of production until at least the end of April. This supply buffer looks particularly comfortable in relation to current global demand, which remains well below pre-pandemic levels. However, we expect spare capacity levels to trend lower over the course of this year as OPEC+ cautiously restores more supply and as the global demand recovery continues to unfold. Even assuming US sanctions on Iran are lifted midyear (which would return 1.5 mb/d of Iranian spare capacity to the market), we forecast OPEC+ spare capacity will fall to 5% of global demand by year-end — still high on a historic basis, but less than half of the June 2020 peak.

The remaining OPEC+ quotas are set to end after March 2022, allowing producers to reactivate much of the capacity that is currently offline, while the demand recovery will continue well into next year. This makes it vital to understand which countries maintain spare capacity and how much production capacity has been eroded by natural declines and underinvestment. Unsurprisingly, our data reveal that Saudi Arabia and its GCC neighbours control the largest share of OPEC+ spare capacity. The OPEC+ agreement also means that at present, Russia, Iraq and several other countries have much more spare capacity than at any previous time, while US sanctions are still severely restricting Iranian output.

But the figures fundamentally show that OPEC+ spare capacity is less plentiful than market consensus assumes, setting the scene for a supply crunch as balances continue to tighten.

Source: Energy Aspects

Related insights