Media Coverage

Welcome to our Media Coverage page. Explore the latest appearances and insights from our analysts as featured in major media outlets, and stay informed with our expert commentary on the ever-evolving energy landscape.

For any press-related enquiries or further information, please visit our press enquiries page.

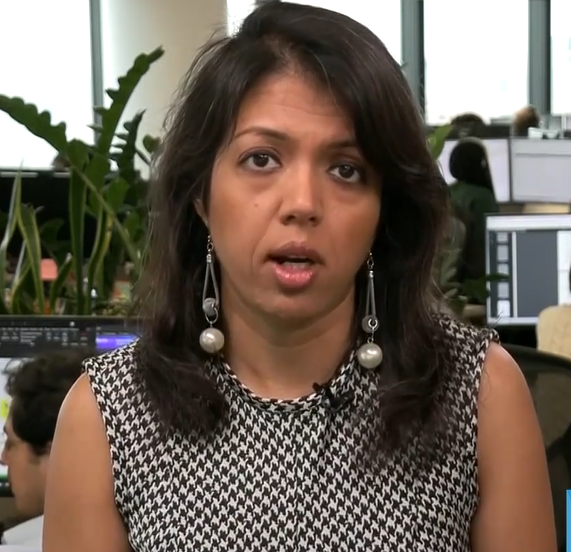

"From 2027 it gets worse. We've got more closures coming. We are in for a period of very high refined products prices even if crude doesn’t go up."

Bloomberg Wall Street Week - 07.05.2025

Bloomberg's Wall Street Week visited our London office last week to interview Energy Aspects’ Founder and Director of Market Intelligence, Dr Amrita Sen, to discuss the outlook for products prices and the refining sector as facilities close their doors.

Watch the interview here from 19:00 →

Traders Flock to Niche Options Market to Bet on Crude Oil Glut

Bloomberg - 05.06.2025

“There is a lot of risk in the trade...[rising activity has been driven by] strong prompt, weak deferred balances, and a very changeable geopolitical environment that makes holding futures difficult".

Energy Aspects Founder and Director of Market Intelligence, Dr Amrita Sen, joined CNBC Squawk Box to discuss the state of the energy market, oil price trends and natural gas

CNBC - 03.06.2025

"Oil's rallies will be capped…I can't see how we go to 70 or 80 dollars unless there's a big geopolitical outage".

Gallarati: Not a Bad Time for OPEC+ to Increase Production

Bloomberg UK - 30.05.2025

Oil has been trading lower ahead of an OPEC+ meeting on output which is expected to lead to another supply hike. Livia Gallarati told Bloomberg that the timing of the supply hike may be beneficial.

Murban crude prices drop as OPEC+ raises output, prompting surge in volumes to Asia

Reuters - 23.05.2025

"Asian markets have been oversupplied with light grades for most of this cycle, driven by outages at Japanese refiners, increased UAE availability this cycle following the accelerated OPEC+ unwind, and planned maintenance at Saudi Arabia's Petro Rabigh refinery".

Oil markets slide as Trump says U.S. is close to a deal with Iran

BNN Bloomberg - 15.05.2025

Jeremy Irwin joined BNN Bloomberg to his analysis of Trump's visit to the Middle East as oil markets slide on fear of excess supply.

Oil market 'smile' suggests Saudi Arabia's output shift was well timed

Reuters - 08.05.2025

Richard Price said the structure was a result of tight prompt supply coupled with expectations of U.S. President Donald Trump's trade wars slowing economic activity later in the year.

Why OPEC Plus Is Increasing Oil Supplies Despite Falling Prices

The New York Times - 06.05.2025

“The view from Saudi Arabia, in particular, is that they no longer want to be the ones carrying the heaviest burden if other countries in the group are not showing sufficient commitment to doing their part".

California's Fuel Industry is Shrinking

Bloomberg - 26.04.2025

“The signal from having low supply will be even higher prices. Ultimately, you can get to a point where the price has to get so high to kill demand, because there is just not enough [fuel available]".

India eyes ending import tax on US ethane and LPG in trade talks, sources say

Reuters - 16.04.2025

"It will be challenging for the US to increase ethane exports to India, as India seems to have already maximised its use of ethane as a feedstock due to favourable current margins".

Brent crude dips below $60 per barrel for first time in 4 years

Financial Times - 10.04.25

“This is escalating, not de-escalating. Some of it will get negotiated away but a lot of it will not. I think we are looking at a much weaker global growth and global oil demand scenario, and that’s what’s getting priced in".

OPEC+ Struggles to Rein In Biggest Cheat Despite Saudi Arabia’s Scolding

Bloomberg - 09.04.2025

“This is a warning shot to say: get in line".

Kitt Haines joined CNBC-18 to discuss the road ahead for crude amid the tariff war

CNBC-18 - 08.04.2025

“Nobody really knows how much these tariffs are going to stick, how long they are going to stick for, what levels they are going to stick for, if they get changed at all. I think that just creates a really bad environment in general for business".

German Power Prices to Stay High as Link to Gas Seen Stronger

Bloomberg - 08.04.2025

“Renewables will still be able to cover a high proportion of German electricity demand, but fossil fuels, and increasingly gas-fired power generation, will still be needed to cover the last few kilowatt-hours, and will therefore set the price".

European Gas Set for Weekly Loss as Households Turn Off Heaters

Bloomberg - 28.03.2025

“Low European stocks on 1 April will mean a significant increase in Europe’s injection demand year-on-year, just to get back to stocks that broadly satisfy the continent’s binding storage targets".

Bloomberg Surveillance Podcast

Bloomberg Surveillance TV - 26.03.25

Dr Amrita Sen joined Bloomberg Surveillance to talk about uncertainty surrounding global energy prices in the coming months.

Putin’s key demand is designed to inflict maximum damage on Ukraine

The Telegraph - 19.03.25

Livia Gallarati joined The Telegraph to discuss the growing impact of Ukrainian drone strikes on Russia’s oil infrastructure, highlighting how sustained attacks have led to a tangible decline in refinery output and disrupted global energy flows.

Dr Amrita Sen joined Bloomberg: The Close to discuss her forecast for crude oil prices

Bloomberg: The Close - 17.03.25

"Banks are kind of talking about $50 to $60, we are more like $75 to $80 for the simple reason that, look, actually the macro fundamentals for oil look absolutely fine".

Impact of tariffs on North American crude market

BNN Bloomberg - 12.03.25

"There's a lot of macro headwinds and fear about demand slowing due to tariffs et cetera, but underneath the hood, oil fundamentals look quick supportive".

"'Drill baby drill' is purely rhetoric. It hasn't led to any increase in US production, and we don't think it's going to lead to any increase in production".

CNBC - 13.03.25

Oil markets have been surrounded by bearish noise recently, with POTUS's calls for increased US production, Russian sanctions lifting and traders' fears of OPEC+ flooding the market. Despite market sentiment, the reality is that balances are supportive and stocks are drawing.

Trump’s Energy Tariffs Are Set to Spark a Redrawing of Oil Flows

Bloomberg - 04.03.25

"If the duties endure, tariff-free Latin American oil grades from places like Brazil will start to head to the US in greater quantities, along with possibly more supplies from the Middle East".

Russian, Iranian oil supply to China rebounds as new vessels cash in on the trade

Reuters - 28.02.25

"More pressure from U.S. president Donald Trump on Iranian exports is expected to result in a slowdown of shipments to China and eventually force Iranian production lower over a number of months".

India’s biofuel push a success, but green hydrogen remains costly

CNBC TV - 13.02.25

Dr Amrita Sen joined CNBC TV during India Energy Week to discuss India in the energy transition and the wider oil market.

China Refiners Set to Resell US Oil Cargoes After Tariff Blitz

Bloomberg - 06.02.25

"Some regional light crude prices will be supported as a result. Murban and Libyan grades [are] among top options for May arrivals, with North Sea light grades and CPC as alternatives".

Canada Oil Tariff ‘Massive Loss for US Refining,’ says Energy Aspect’s Sen

Bloomberg - 03.02.25

Dr Amrita Sen joined Bloomberg Surveillance to discuss the potential impact of President Donald Trump’s 10% tariff on crude oil from Canada, which she called “a boon for Asian refiners” and a win for a lot of the rest of the world.

Trump's oil tariffs a boost for European and Asian refiners

Reuters - 02.02.25

"Asian refiners could get the competitive advantage because they have the equipment to run heavy crudes and are also in the midst of raising their run rates".

Oil ticks up after hours on possibility of lower US tariff on Canadian oil

Reuters - 31.01.25

"Our base case has been that, if tariffs are announced, they will include a grace period for negotiations and that oil is likely eventually to be carved out from any tariffs".

Europe may need over 100 extra gas cargoes to refill shrinking stocks

Reuters - 22.01.25

"Europe will need to maintain high prices to continue attracting spot and divertible LNG supply away from Asia".

Global diesel prices spike as US hits Russia with new sanctions"

Reuters - 17.01.25

"Diesel [profit margins] are up following news on the sanctions, and we expect meaningful disruptions to Russian diesel exports".

"High-level estimates, we see half a million to a million a day of Russian Crude deliveries into the Asian market being disrupted"

BNN Bloomberg - 15.01.25

Jeremy Irwin, joined BNN Bloomberg to discuss anticipated developments in the oil sector.

Cold wave sweeps across the United States, pressure on natural gas production pushes prices higher

Yicai - 11.01.25

Dr Amrita Sen joined China Business News to discuss the impact of the extreme cold wave sweeping across much of the United States on natural gas production.

Trump will struggle to drive down oil prices

Financial Times - 09.01.25

In a recent op-ed for the Financial Times, Dr Amrita Sen and Jesse Jones explored the challenges President-elect Donald Trump faces in his quest to lower oil prices.

Natural gas production under pressure from cold weather, says Energy Aspect’s Amrita Sen

CNBC - 06.01.25

Dr Amrita Sen, joined CNBC's 'Squawk Box' to discuss energy prices as January temperatures hit record lows.

OPEC+ wary of US oil output rise under Trump

The Express Tribune - 19.12.24

"This is a potentially difficult dynamic for both sides... OPEC+ has faced a big challenge from rising US production, which has reduced the group's influence".

Global diesel prices to rely on refinery closures for support in 2025

Reuters - 12.12.24

"For 2025, we are constructive on European diesel prices due to the capacity closures, still low forward margins that will keep utilisation levels relatively low, and a slight rebound in demand".

European Power Tops €1,000 as Weak Wind Drives Up Gas Generation

BNN Bloomberg - 11.12.24

"German wind generation is even lower than the already low forecast levels".

Oil markets shrug off Assad’s overthrow

New York Times - 09.12.24

"There’s still a residual view that the oil market will be oversupplied next year... [but] the market will have to see it to believe it."

Outlook for oil and energy markets

BNN Bloomberg - 04.12.24

Dr Amrita Sen, joined BNN Bloomberg to share her predictions for the oil and energy markets.

"OPEC+ will not add to a surplus market"

CNBC - Capital Connection - 02.12.24

Dr Amrita Sen, joined CNBC’s Capital Connection to discuss a roll over of current cuts by OPEC+. ahead of the group’s meeting on Dec. 5.

Gazprombank sanction “workaround” likely to keep gas flowing

Montel News - 28.11.24

"There is too much supply at risk for there not to be a workaround or for the US to carry out the sanction".

"How does OPEC+ plan for 2025 considering compliance issues?"

Gulf International, Energy Podcast - 20.11.24

Can geopolitical risk to oil supply infrastructure in Europe and Mideast keep Brent oil prices averaging closer to $75 than $70 through the end of the year?

Oil output in Canada is expected to rise until 2025

BNN Bloomberg - 13.11.24

"We're not seeing strong incentives to grow US production outside of the Permian, which still offers the best break-evens".

Carbon markets give environmentalists hope after US elections

Reuters - 13.11.24

Luke Sherman said the ballot result should give similar efforts elsewhere a boost.

"There's a bit more social acceptance than we have previously assumed"

Trump return will slow, not stop, US clean energy boom

Reuters - 06.11.24

"Presidents can make a lot of noise about plans for U.S. oil and gas, but ultimately it's individuals and companies responding to prices of a global commodity that make the decisions on when to drill,"

"OPEC always plays the long game"

CNBC - 05.11.24

Dr Amrita Sen, joined CNBC to discuss the outlook for oil as OPEC+ announced a one-month delay to the planned unwinding of voluntary production cuts.

Washington state vote a harbinger for wider carbon markets

Reuters - 01.11.24

"How ambitious they want to be could certainly be influenced by their perception of voter support or rejection of carbon pricing in Washington".

LNG-fuelled trucking accelerates in Asia, denting diesel demand

Reuters - 23.10.24

"India will not have the same penetration rates as China but improved infrastructure has reduced inefficiencies already, and Indian diesel demand growth may have peaked as a result,"

"Given China and India have been the key diesel demand growth centres, the weakness in both augurs poorly for diesel cracks,"

The energy market is very ‘jaded’ from trading geopolitics

CNBC Squawk Box - 14.10.24

"We need to see if there is an actual outage, that’s when the market is going to trade this".

Cold reality stalks Europe’s looming heating transition

Montel News - 21.10.24

“The sectors in ETS 2 mostly have as their main decarbonisation pathways something to do with power...So every time you reduce emissions in ETS 2, you’re lumping them into the power sector, which is covered by ETS 1.”

Texas natural-gas pipeline eases bottlenecks, paves way for higher shale output

Reuters - 18.10.24

"Matterhorn will help unlock higher Permian oil output...Most of the Permian's estimated 2025 oil-production growth would be unfeasible without more gas pipeline capacity."

China Oil Imports Slowed in September on Weak Margins, Repairs

Reuters - 18.10.24

“We expect Chinese crude imports to hold around 11 million barrels a day through the fourth quarter”.

Europe’s new normal: High energy bills, fading industry and one chance to fix it

Politico - 10.09.24

"Germany is clearly the laggard in economic activity or performance in Europe right now, In the long term, it really brings into question the country's position in the global industrial order.”

Israel's Iran retaliation looms over oil markets

BNN Bloomberg - 09.10.24

"The market has been absolutely focused on what is going on in the Middle East right now, and we have seen a significant increase in oil prices in the last week on the back of fears that the current tensions may escalate into infrastructure attacks on the energy side."

Oil prices sink on worries over Chinese demand

Financial Times - 08.10.24

“Given the lack of damage to refineries or upstream platforms, the hurricane will probably be net bearish for oil markets by hurting demand”.

Are the UK’s Russian financial sanctions working?

Parliament Live Tv

Richard Bronze provided evidence in the UK Parliament to a Treasury Select Committee inquiry, examining the impact of Russia sanctions and the oil price cap This session delved into the intricate world of international energy politics, with Richard shedding light on these critical issues.

- The complexity of the oil price cap and the enforcement challenges created by the growing shadow fleet

- The impact of Western sanctions on Russian energy revenues and efforts to shift Russian trade into alternative currencies

- How effectively OFSI is implementing UK sanctions and how it compares to the OFAC in the US

- The possible impact on LNG markets and gas prices of sanctions on Russian LNG currently being considered by the EU