Three-month delay to OPEC+ voluntary cut unwind likely; UAE quota increase may get delayed

4 December 2024

- We expect the unwinding of voluntary cuts by eight OPEC+ countries to be delayed by three months to April.

- Three-month delay reduces our commercial crude builds from 0.6 mb/d to 0.1 mb/d; longer delay would remove builds entirely.

- OPEC+ may discuss a longer delay but, with President Trump incoming, we think the group will prefer retaining flexibility.

- Implications of Trump’s trade tariffs and Iran sanctions policies are key variables for the market and OPEC+ to assess.

- Full OPEC+ group may also delay increase in UAE production quota to align it with voluntary cut unwind.

We expect tomorrow’s OPEC+ meeting (5 December) to delay the unwind of the voluntary production cut through peak refinery maintenance—most likely by three months—as the group will not want to add barrels during seasonal crude builds. Saudi energy minister Prince Abdulaziz bin Salman has long maintained that the group wants to ensure inventories remain below the five-year average. The group is likely to remain reactive and cautious given the numerous uncertainties about how the incoming Donald Trump administration in the US will impact oil markets. Our current balances assume the group unwinds the cuts from January and a three-month delay, for instance, would reduce our commercial crude builds from 0.6 mb/d to 0.1 mb/d. A delay of four or more months would remove these builds entirely.

Decisions about the schedule for unwinding the 2.2 mb/d of additional voluntary cuts are taken by the eight countries participating in those cuts. The only item that would need to be agreed by all OPEC+ ministers is any change to the plans for the UAE production quota, which is currently set to gradually rise by 0.3 mb/d over January–September 2025. We believe this may get pushed back to align it with the delayed start to unwinding voluntary cuts, although this is not yet certain.

We understand the group may also consider a four- or six-month delay—and there has been market chatter suggesting the delay could be as long as 12 months. The argument for such a move would be to deliver a bullish surprise, but this would reduce the optionality to make further adjustments during H1 25, as the trajectory for inventories and Trump’s policies become clearer. In particular, we think Saudi Arabia will want to see a clear physical impact from any Trump policies before supporting OPEC+ policy changes. As such, we think the group will opt for a delay of three months to retain more flexibility next year.

Caution and compliance remain the watchwords

Given the challenging demand outlook this year, with China’s weakness and expectations of surging non-OPEC supply next year (even though it disappointed this year), many in the market believe the OPEC+ deal must be on the brink of collapse. But we maintain our view that this is incorrect. It is true that there are frustrations within the group, both over the compliance laggards and the fact that many traders dismiss the group’s ability to manage the market, but we still sense a widespread acceptance within OPEC+ that continuing to collectively limit production is a better strategy than any of the available alternatives.

A major focus for OPEC+ leaders this year has been improving compliance, particularly from Iraq and Kazakhstan—the Russian and Saudi energy ministers met with both countries again last week. There was not much follow-through by either country on promises made in April or July, but there has been more action since August. Iraq has reduced output by almost 0.3 mb/d and planned maintenance has improved Kazakh compliance. Neither country is managing full compliance, especially if promised compensation cuts are factored in, but overproduction has been significantly reined in since the summer, a shift that the market may not have fully recognised. Ongoing issues at Kazakhstan’s Tengiz field and the outage at Iraq’s Basrah refinery are also curtailing production in the short term.

Consensus views on 2025 balances are starting to shift, with various analysts quietly revising projections of huge 2+ mb/d builds lower. The OPEC+ delay will provide more momentum to this shift, but significant uncertainty will hang over next year until there is more clarity on Trump administration policies. These range from the potential for tariffs to weigh on global demand and efforts to boost US production through to potential tightening of Iran sanctions and more. OPEC+ countries may therefore need to further delay the unwinding schedule in the spring depending on the outlook at that point, which we believe they will be able to agree if necessary.

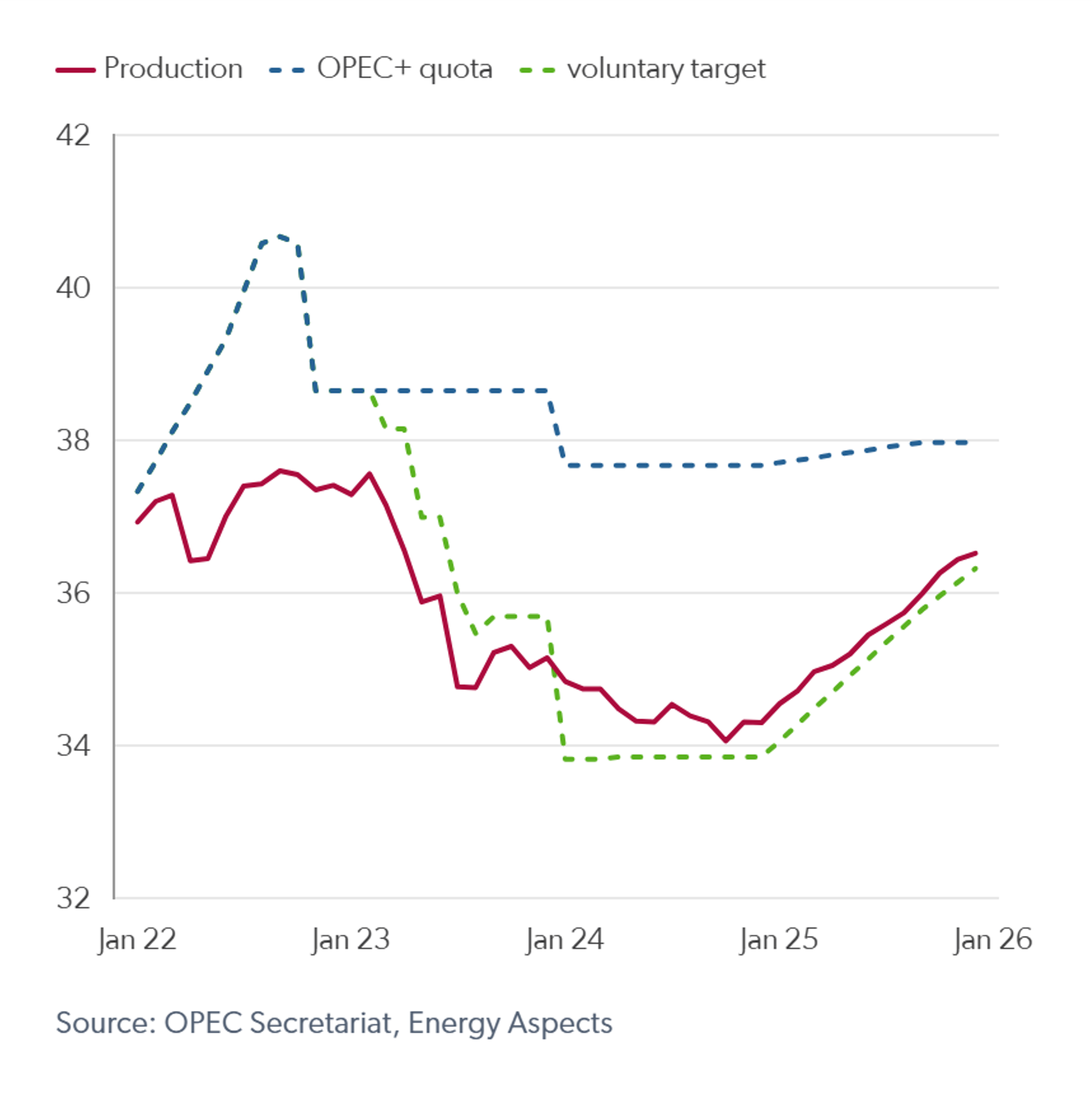

Fig 1: Current OPEC+ crude supply forecast, mb/d

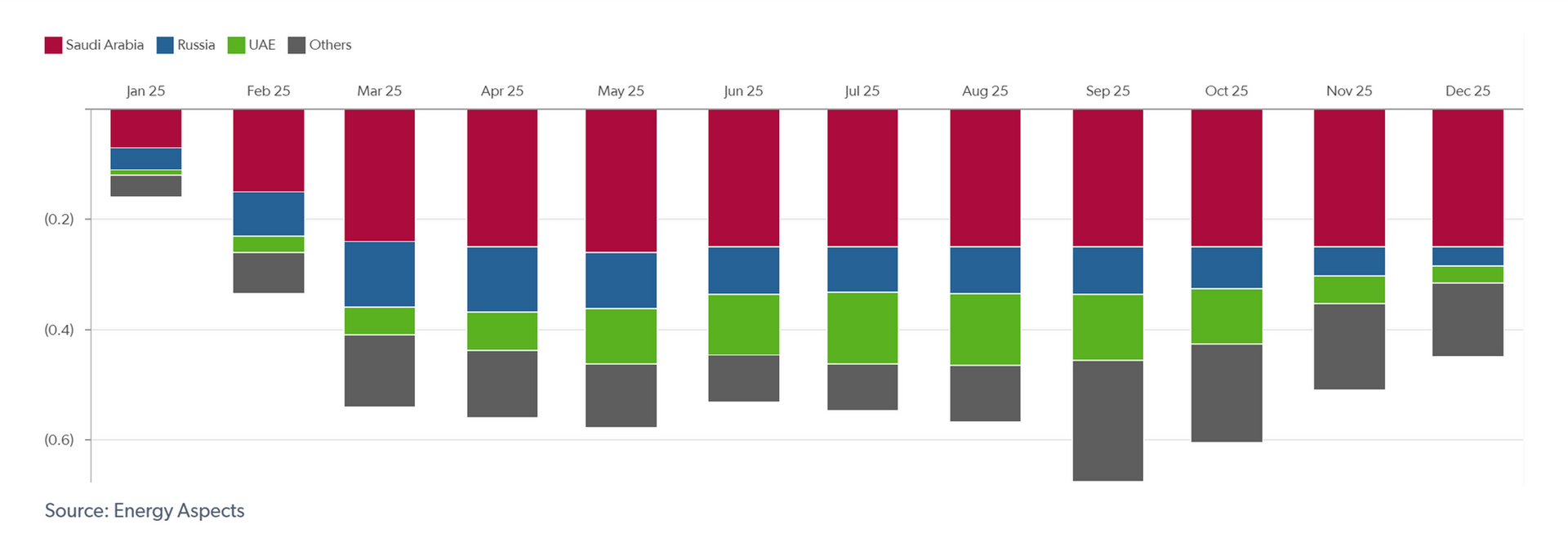

Fig 2: Impact of three-month delay by country, mb/d