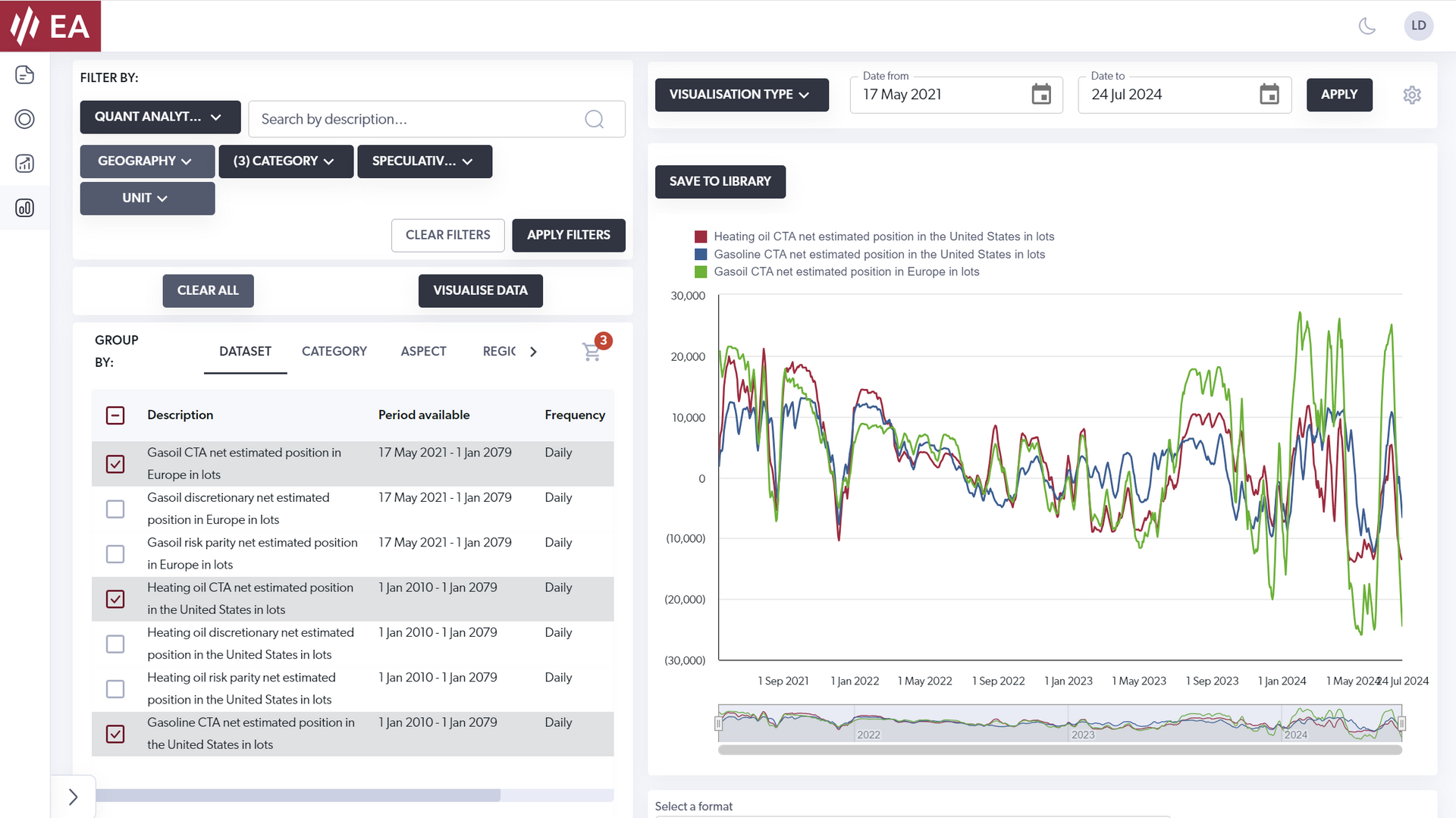

Quant Analytics

Applying scientific principles to market-orientated thinking

Gain an edge with our quant insights

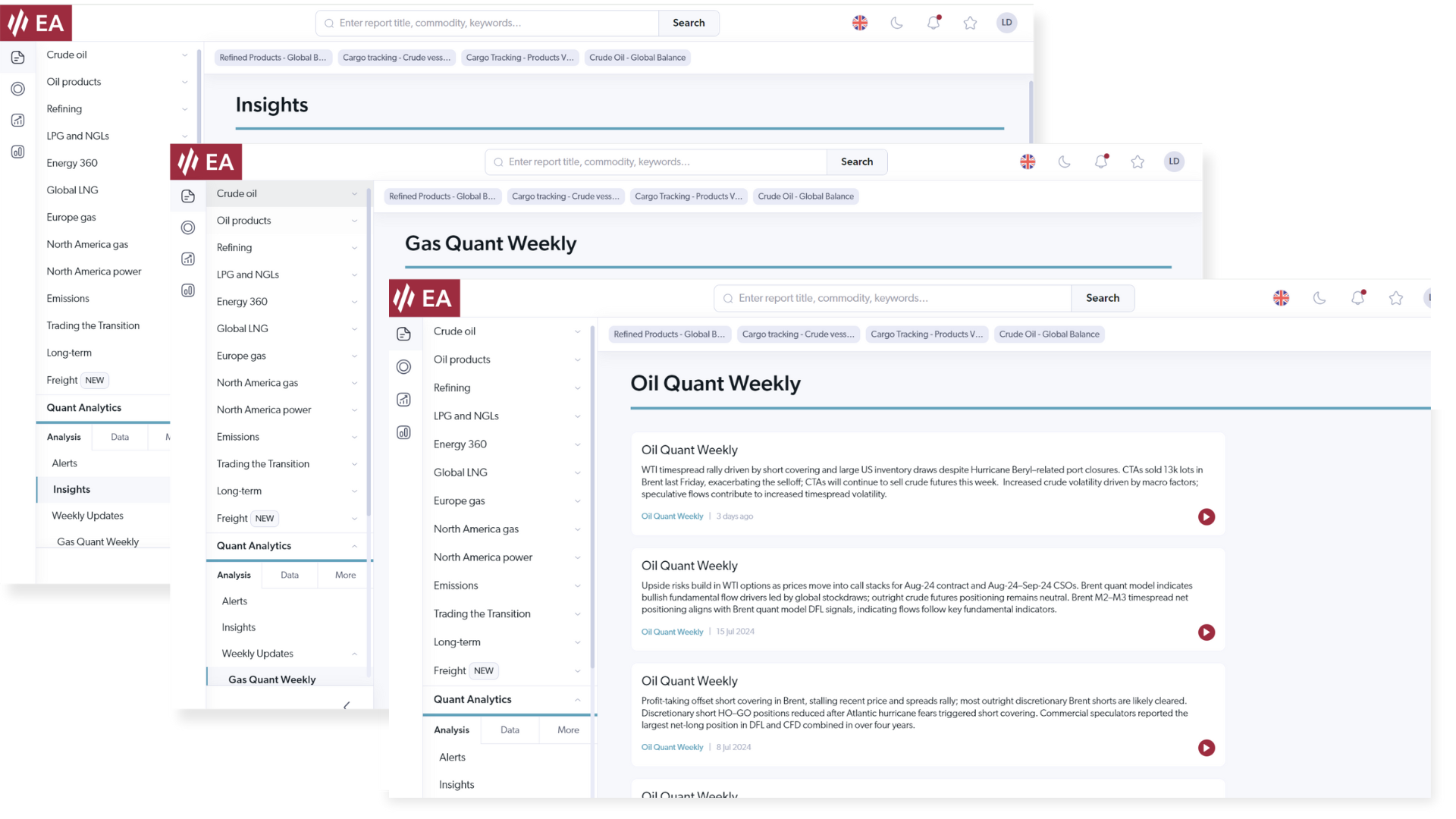

Stay ahead of the curve by accurately anticipating market positioning and flows across markets.

Understand the complete picture

Analysing financial flows has become increasingly important in recent years due to the influx of discretionary capital. Physical fundamentals alone no longer explain price movements in markets. Our expert quantitative analytics help you gain a comprehensive understanding of the market through:

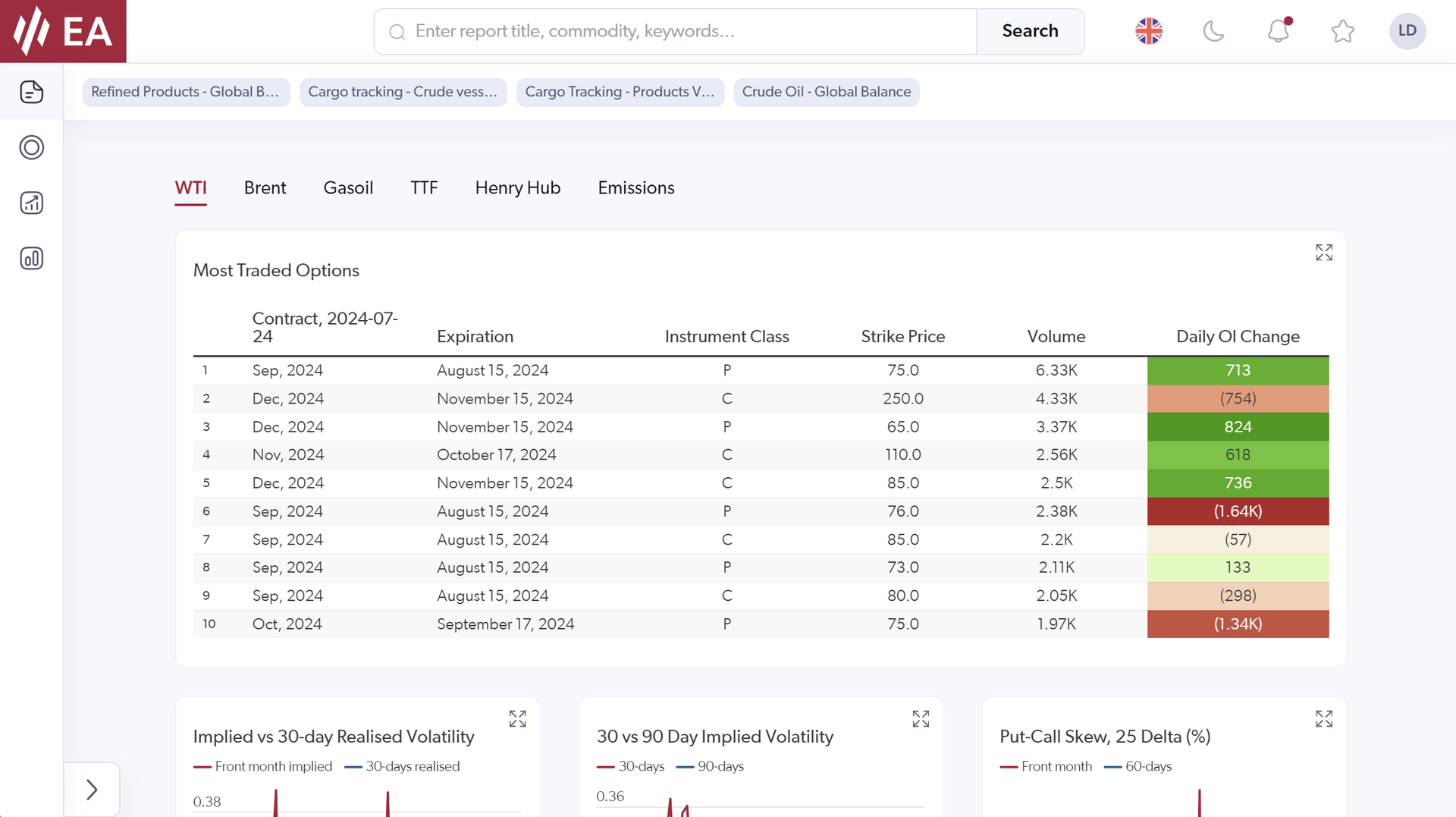

Cutting-Edge data-driven research

- Access to in-depth quantitative research designed to help you determine the most relevant price drivers in markets.

- Our systematic framework provides actionable insights, empowering you to make decisions with robust, timely data.

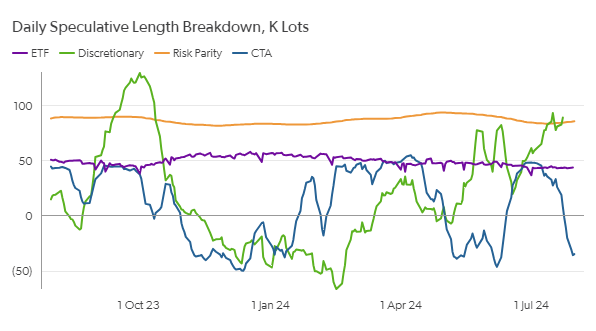

Modelling all major market participants

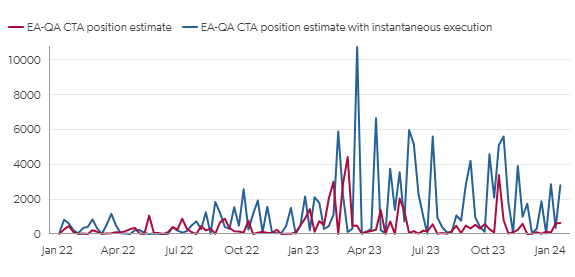

- We distinguish ourselves from other providers by modelling and isolating ALL major participants, not just CTAs.

- Additionally, we track the positioning of participants in addition to their flows, offering a complete and comprehensive view of the market.

Blending models and human expertise

- The Quant Analytics service merges quantitative rigour with years of experience in commodity derivatives trading.

- Through methodical analysis of quantitative data, we isolate and tag significant trade flows to either speculative or commercial traders, offering critical insights into market risk dynamics.

Equip yourself with timely information that drives critical decision-making.

How Quant Analytics works

Dr Nicky Ferguson, Head of Analytics, explains how Quant Analytics works and how it can be used on the EA Client Portal.