Permian H1 24 gas production forecast lowered on pipeline outages, limited local demand

6 Apr 2024

- Drawdown constraints in late February cause position exodus, exacerbating the price decline. We are reducing our Permian gas production forecast by 0.2 bcf/d through H1 24 on pipeline maintenance, limited local demand.

- Bottlenecks should alleviate this summer on the Q3 24 start-up of Matterhorn Pipeline’s 2.5 bcf/d of Permian exit capacity.

- HDDs realised 30% below average from February–March, with shoulder-season demand declines set to further strain pipeline exit capacity.

- Waha negative cash price realisations are a risk as Gulf Coast Xpress and NGPL maintenance continue through end-May.

- Upstream production dynamics are unchanged, with marginal crude output growth y/y supporting gas gains once pipeline capacity expands.

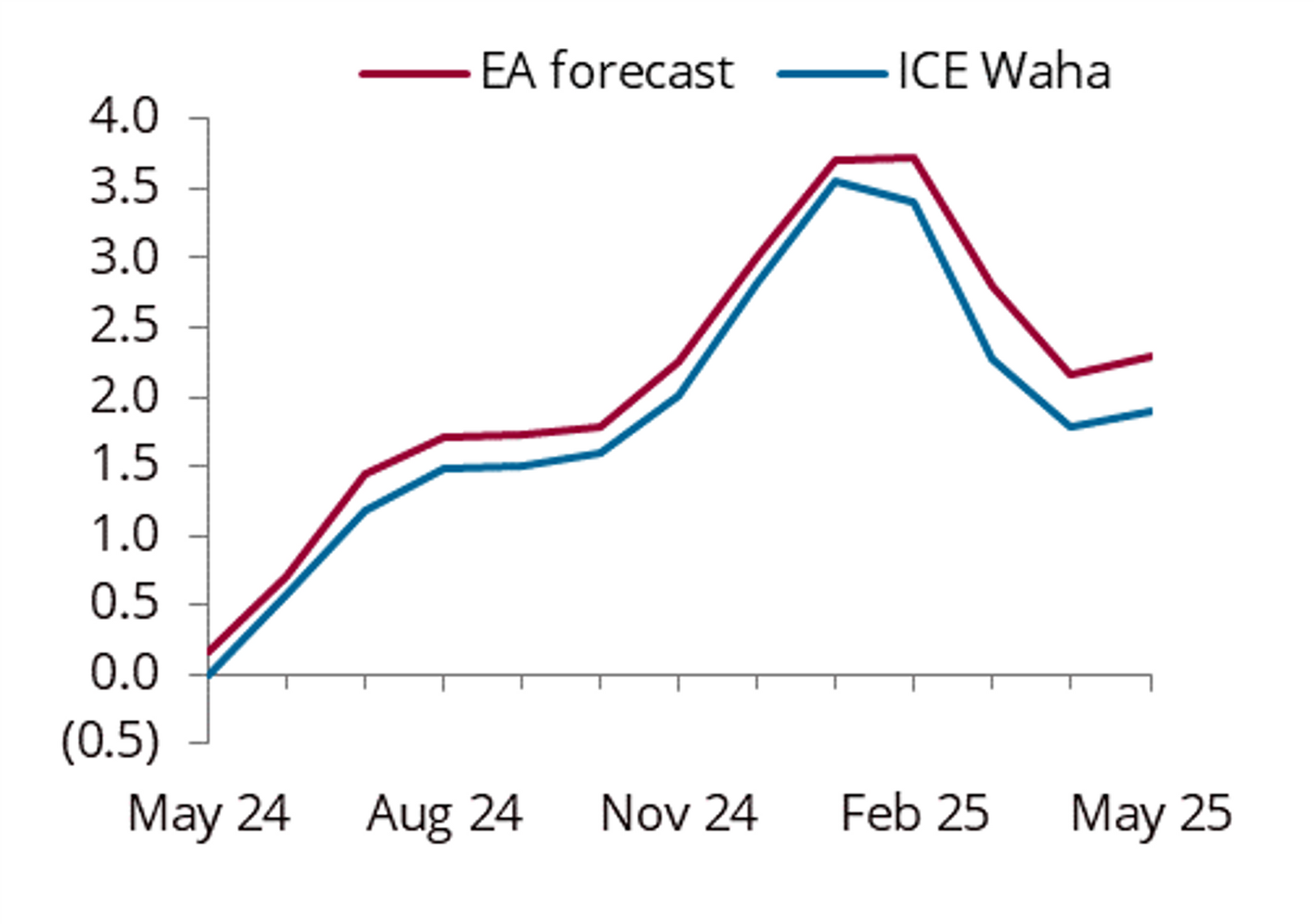

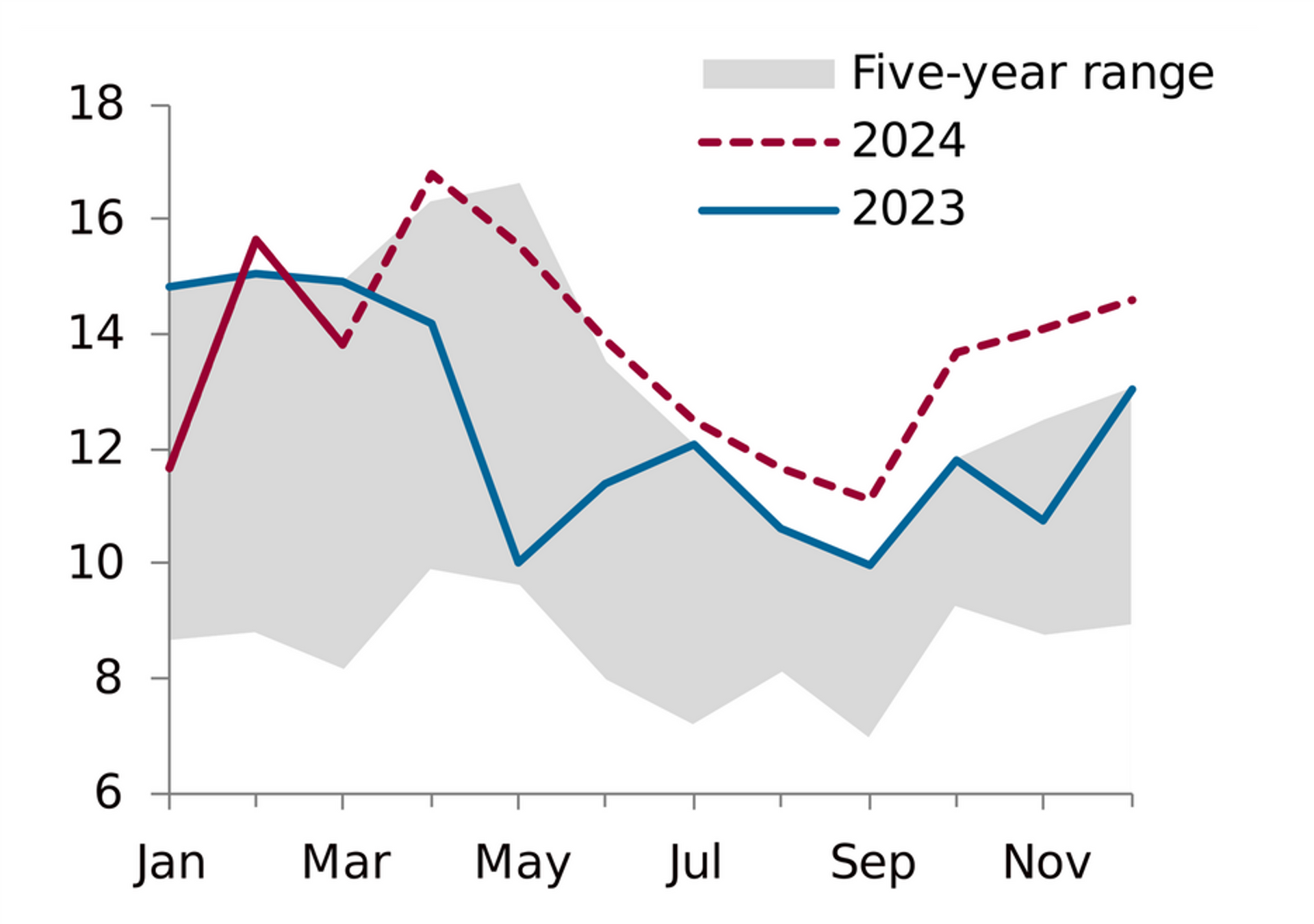

We are cutting our Permian gas production forecast by 0.2 bcf/d in Q2 24 as pipeline maintenance and depressed local demand combine to shrink the outlets available for the basin’s output in the shoulder season. Permian production peaked at 17.7 bcf/d in November 2023 and reached a monthly average apex in December at 17.0 bcf/d. We do not anticipate the basin will return to a monthly average of 17.0 bcf/d until June 2024, which is also the month our crude team expects Permian monthly crude production to exceed last November’s peak. Flows have only topped that threshold on one day since the end of freeze-offs in early January, registering 17.0 bcf/d on 31 March. We expect the 2.5 bcf/d Matterhorn Pipeline will commence operations in August 2024, alleviating Permian exit capacity bottlenecks.

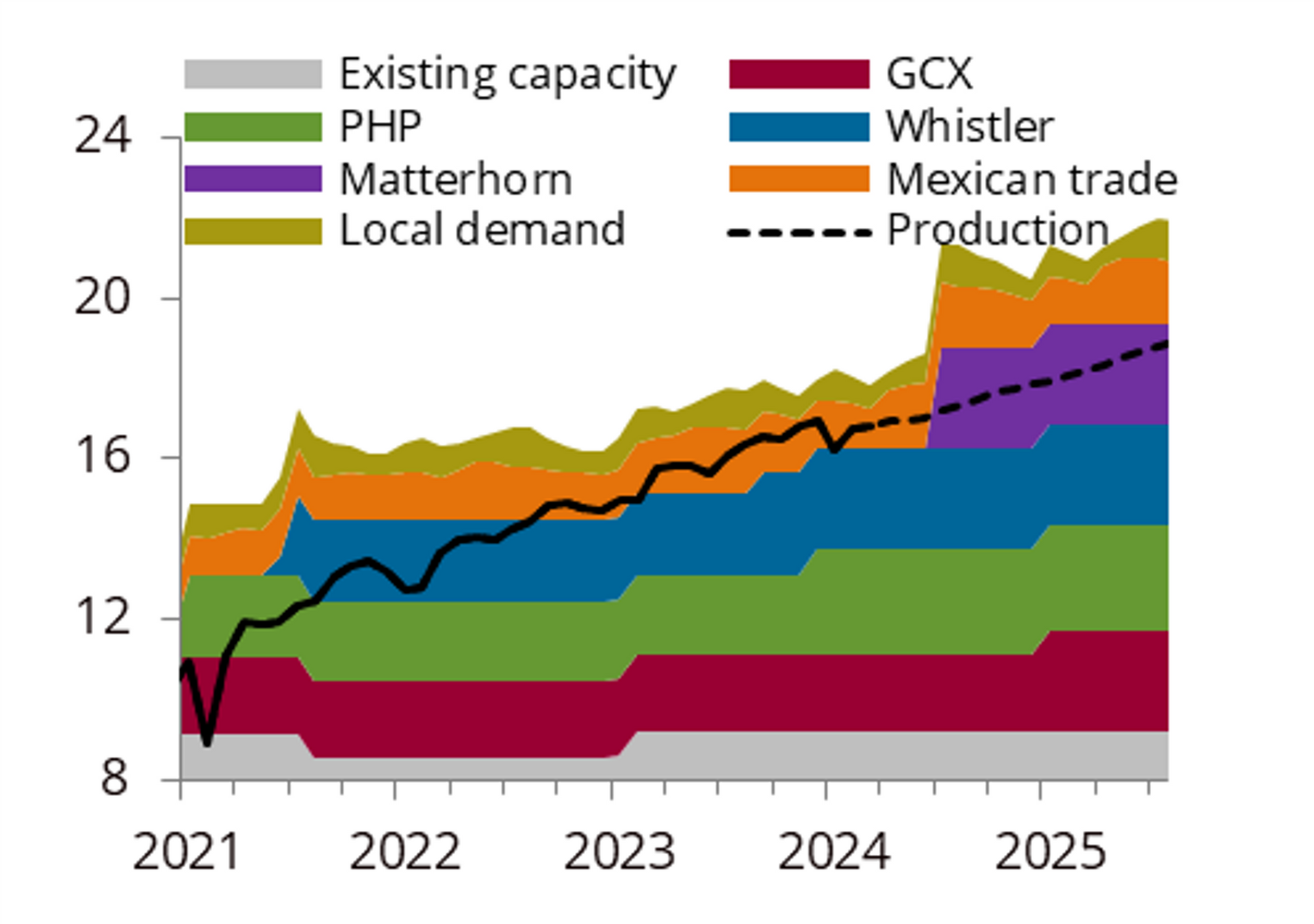

Our timeline for Matterhorn matches the project’s internal schedule. Project developer MPLX confirmed in its last earnings call that the pipeline was on schedule to start in Q3 24. Permian exit capacity is currently around 18.6 bcf/d, nearly 1.0 bcf/d higher y/y due to the recent compressor expansions along Permian Highway (0.6 bcf/d) and Whistler (0.5 bcf/d). Matterhorn’s start-up will raise total exit capacity to 21.1 bcf/d. Permian gas output is unlikely to fill Matterhorn capacity with new production before late 2025, though we anticipate a return to m/m gains of 0.15 bcf/d in the basin in H2 24 and an exit-to-exit rate of 0.9 bcf/d y/y, supported by strong oil pricing and the spare west–east capacity.

The current pipeline network is unlikely to be sufficient to maximise Permian production until Matterhorn enters service, given flow restrictions that will be caused by maintenance. Gulf Coast Xpress will begin a series of overhauls to three of its compressors on 9 April, restricting up to 0.3 bcf/d of capacity intermittently through end-May. Northern Natural Gas will also conduct assorted works on its Permian exit lines from 16 April–2 May, with between 0.1–0.3 bcf/d of flows impacted. Whistler does not publicly post its outage schedule as an intrastate pipeline, but deliveries from Whistler onto interstate pipelines indicate flows have yet to recover from reported March maintenance. Further work on NGPL’s Amarillo Line in May and ongoing work on the El Paso system will also restrict the basin’s exit capacity and help choke production gains in Q2 24.

Mild weather has also played a role in stagnant Permian production in 2024. Our Permian pipeline model includes an assumption for 0.5–1.0 bcf/d of local demand to help soak up the basin’s production and limit the amount of outbound gas stressing the constrained exit capacity. But HDDs in the West South Central realised 33% below the 10-year normal from February–March to limit heating demand. This trend is set to continue, not only due to standard shoulder-season demand declines but also with only two days in the 14-day window estimated to have more than 1.0 HDD, despite a 10-year average of 2.5 HDDs over that period.

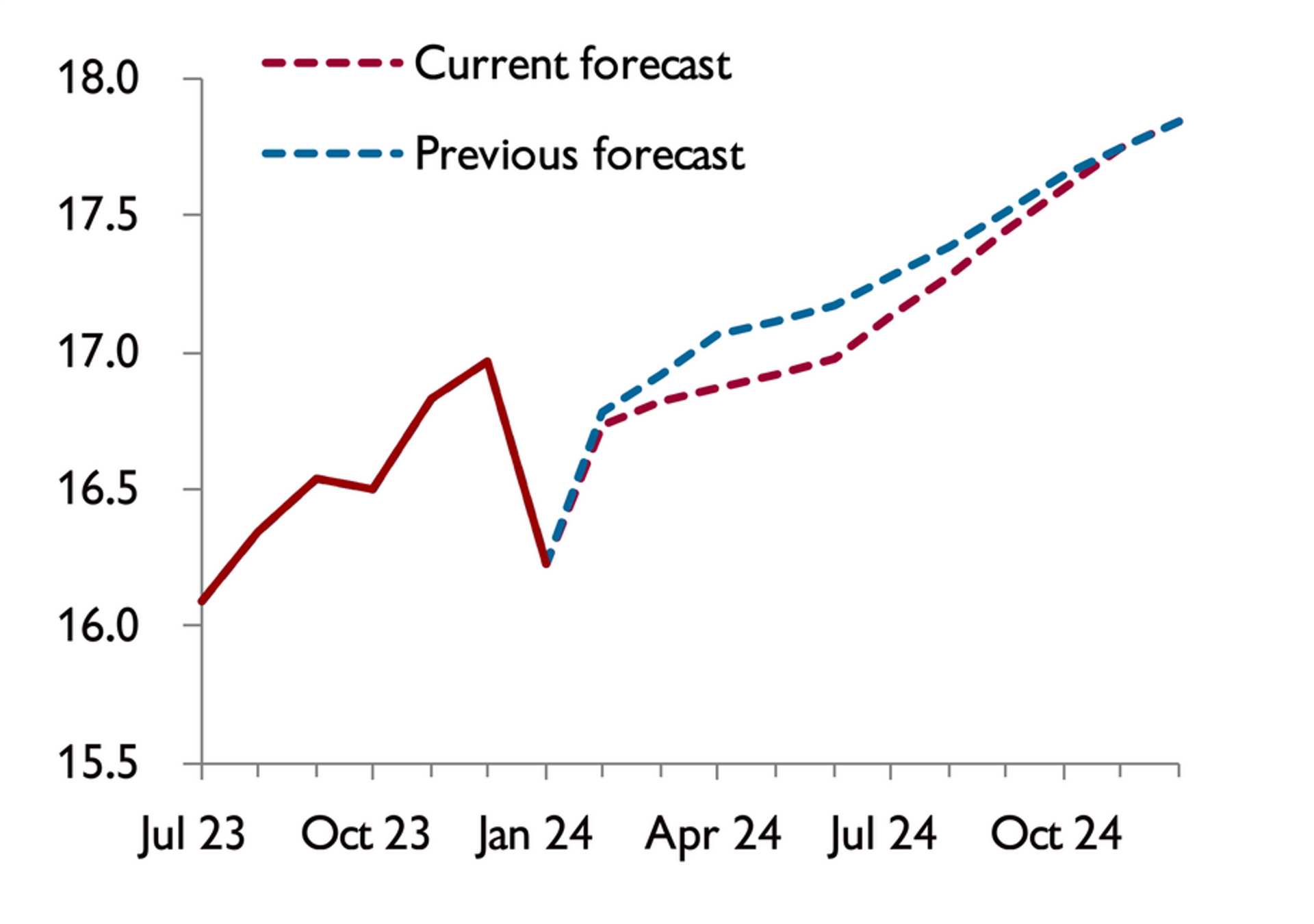

Power load in ERCOT’s West Texas zone is up by 7% y/y since the start of February despite the mild weather on expanding upstream electrification in the oil sector. But renewables generation has risen to meet this demand and will continue to pressure in-basin gas generation. Installed solar capacity is up by 4% y/y in West Texas to 6 GW. We expect ERCOT wind generation will rise by nearly 20% y/y over the injection season to 13.6 GW, including by 33% in Q2 24 following Q2 23’s low wind speeds in the Midcontinent. The lack of local gas demand is taxing Permian gas exit capacity just as maintenance season intensifies.

Prices within the Permian have been depressed due to overall lower Henry Hub cash prices and the constraints driving bearish basis pressure. Waha traded negative intraday irregularly throughout March and realised at a negative daily cash price on 15 March, over the weekend strip of 22–25 March, and at -$0.22/mmbtu for today’s (5 April) delivery. Today’s initial pipeline nominations sunk by 0.2 bcf/d d/d to 16.2 bcf/d. Delivered cash prices at Waha averaged $0.44/mmbtu for the month of March, the lowest monthly realisation since April 2020. Waha risks further downside and potential negative pricing through Q2 24 as more maintenance commences. with yesterday's selloff in both Henry Hub and Waha basis forwards, Waha's May-24 delivered contract is now trading at -$0.02/mmbtu. Downside risks will alleviate once the bulk of maintenance concludes and upon the startup of Matterhorn.

Our reduced production estimate is not based on any change to our upstream or crude production forecasts. Our crude team still expects 2% y/y growth from US producers, with the Permian carrying a higher share than other basins. This will come as E&Ps focus on efficiencies, with faster completion speeds and longer laterals more than offsetting declines in deployed crews and rigs. We expect Permian gas production will grow by 7% y/y, aided by the higher sequential gains in H2 24 once gas infrastructure catches up to productive capacity.

Fig 1: Permian gas production forecast, bcf/d

Fig 2: Permian pipelines and local demand, bcf/d

Fig 3: ERCOT wind generation forecast, GW

Fig 4: Waha delivered price forecast, $/mmbtu