Now for the hard part

22 February 2025

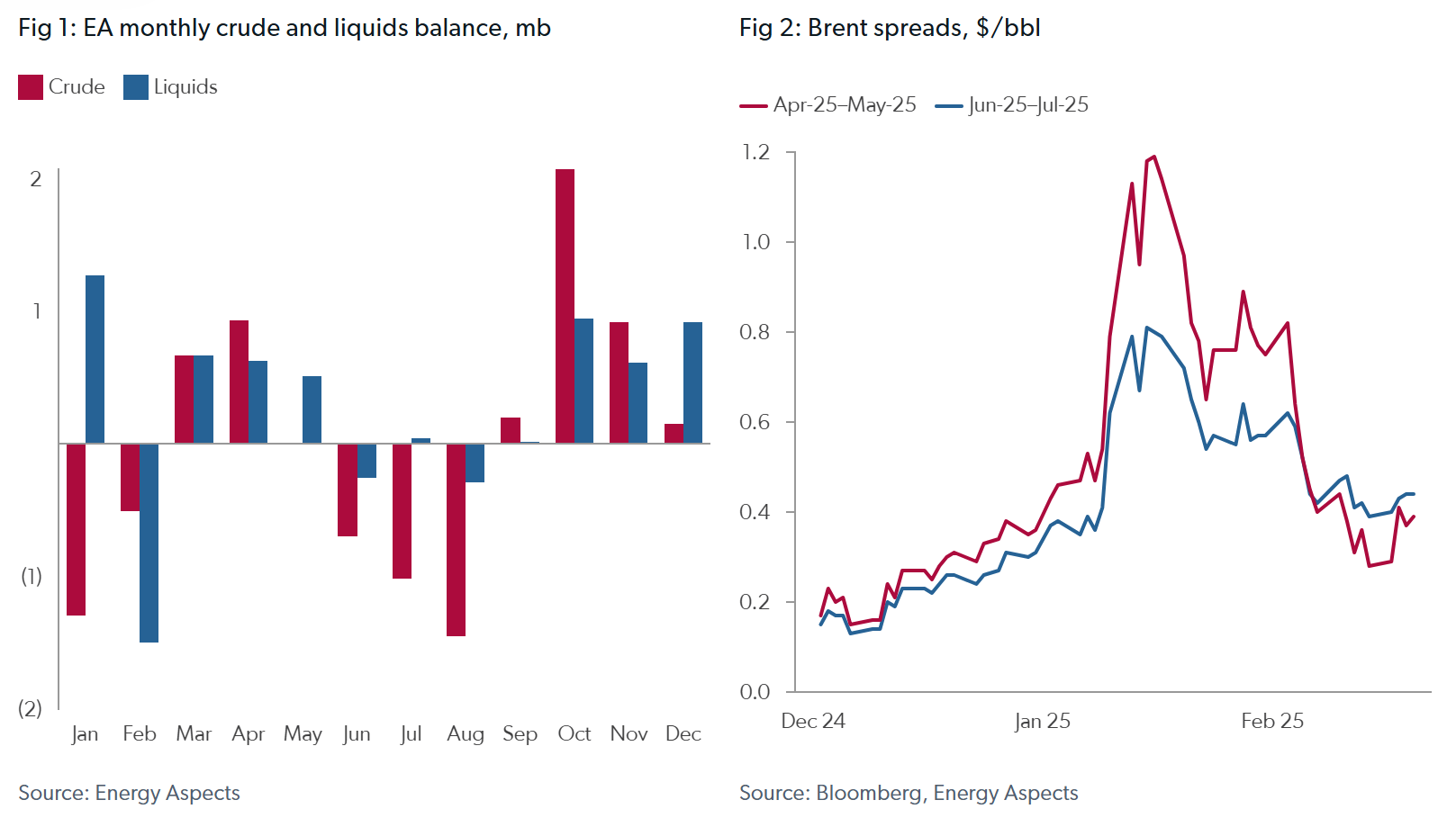

- Crude: Prices supported by broad commodity buying, but flows starting to dissipate; liquidity remains thin until clarity on tariffs and OPEC.

- Products: Front-loaded maintenance supporting European gasoil spreads; EBOB spread strength at risk on faster-than-expected Dangote ramp-up.

- Refining: Strength in global average margins masks the pressure on Asia and secondary unit throughputs from strong sour crude and feedstocks.

- Geopolitics: Maximum pressure campaign against Iran likely to start within weeks; restart of Kurdish oil exports nears but balance impact minimal.

- Macro: US economic outlook clouded by tariff and fiscal uncertainty; sustained optimism around China’s economy could spill over into commodity markets.

- Natural gas: TTF bal-2025 approaches fair value; Europe maintains strong pull on flexible LNG; weather continues to drive HH volatility.

- Transition: US and EU tariffs boost China EV and clean tech exports to emerging markets.

Crude

Oil prices saw an uptick this week, supported by significant buying in broad-based commodity indices as investors continue to hedge against inflation. This buying activity has triggered CTA buying levels, adding further support. But these flows have started to dissipate, and when coupled with ongoing seasonal fundamental softness, this could result in a pullback in flat prices ahead of fundamentals tightening over the summer.We expect liquidity to remain thin as the oil market awaits clarity on key events over the next two weeks, including decisions on Canadian and Mexican tariffs and whether OPEC+ producers decide to extend voluntary cuts beyond April (which we believe they likely will), before traders put on large positions.

Volatility in futures markets, driven by US President Donald Trump's policies and announcements, is making relative-value trades such as sweet–sour spreads much more appealing to market participants. This week, attention focused on US–Russian talks, where senior officials agreed on preliminary steps towards peace in Ukraine. Secretary of State Marco Rubio described it as a "long and difficult road". The steps include reestablishing diplomatic ties, forming teams to discuss ending the war, and considering post-war economic and geopolitical cooperation between the US and Russia. When asked about sanctions removal, Rubio stated that ending the conflict requires concessions from all parties but did not specify what those might be. Sanctions relief will likely be part of a future peace deal, but we do not expect any easing during the process.

Separately, WTI prompt spreads strengthened this week, while April–May spreads also firmed. Brent spreads eased on the prompt but have remained stable for the summer. Volatility in prompt spreads has shifted length down the curve as traders position for strengthening summer fundamentals, particularly due to risks around OPEC+ delaying the unwinding of production cuts and US sanctions policy. Our meetings in Riyadh and Abu Dhabithis week have cemented our view that OPEC+ will not change its policy without clarity on sanctions and tariffs. We therefore think OPEC+ may postpone the planned unwind of voluntary cuts from April, potentially by a few months. So far, the US has not pressured OPEC+ to increase production pre-emptively ahead of potential

sanctions-led supply disruptions, despite market speculation.

Finally, physical markets were quiet this week, with market participants still assessing the impact of the disruption to CPC pipeline flows, which remains murky. Russia may seek to use the disruption as political leverage, muddying the scale of potential supply disruptions for the time being. Our conversations with CPC shippers and buyers indicate that flows on the line may have fallen by anywhere between 50–400 kb/d, while repairs could take six to eight weeks. Some of our contacts believe that Russian CPC exports (which utilise the same infrastructure as Kazakhstan’s CPC) and potentially some Tengiz deliveries have been disrupted. Flows from the Kashagan field remain unaffected.

Products

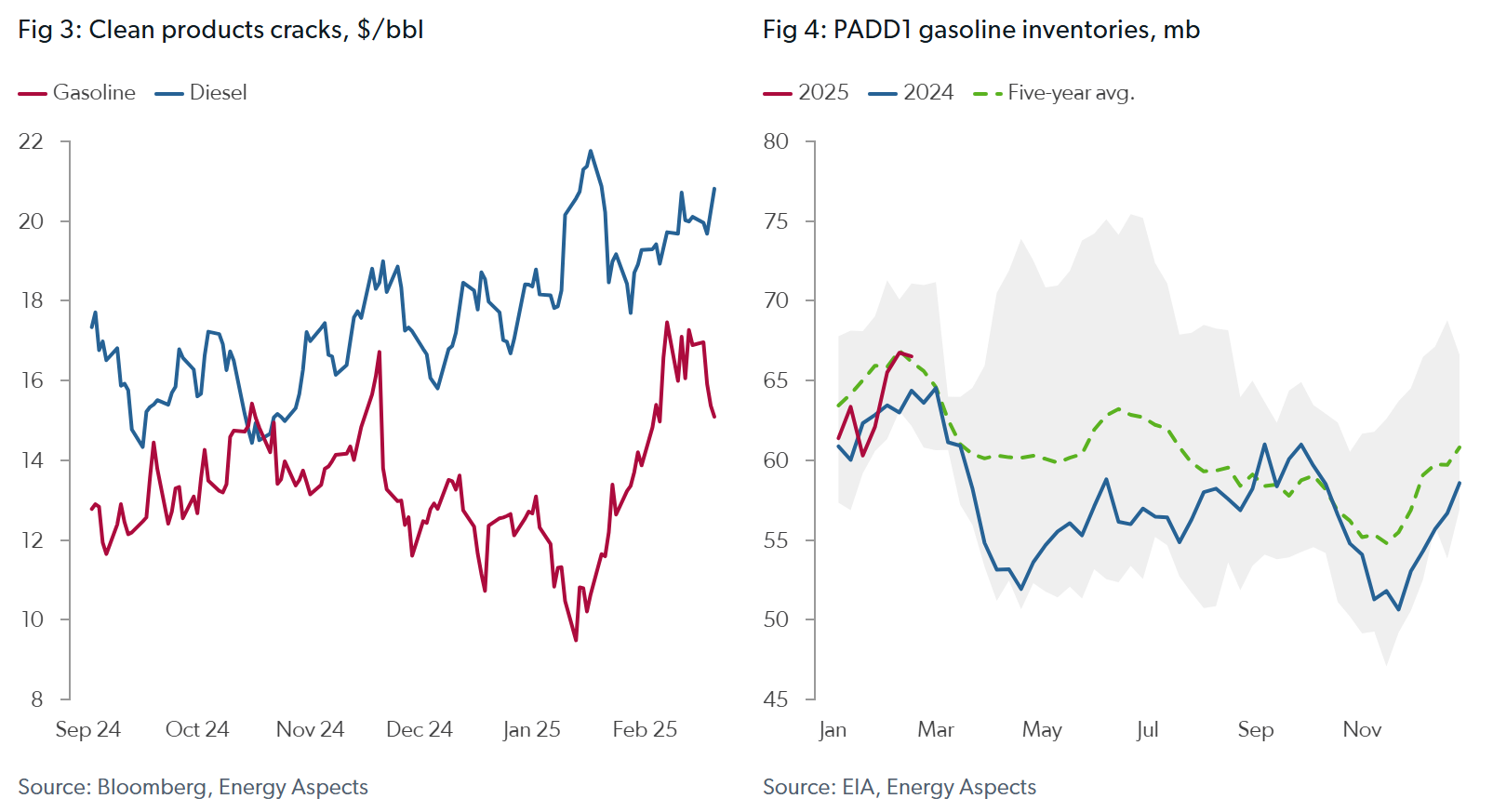

Prompt ICE gasoil spreads strengthened this week as CDU maintenance in Europe is expected to average 0.34 mb/d higher y/y in February. Unplanned Russian refinery outages have risen by 0.41 mb/d m/m in February due to Ukrainian drone strikes, reducing diesel exports by 67 kb/d m/m (50 kb/d below the five-year February average). We expect spreads will stay strong at the prompt even if heating demand comes off seasonally, as a front-loaded refinery maintenance season globally will keep supply pressured. But we expect little upside to cracks beyond the $17–20/bbl range they have been trading in, barring prolonged supply disruptions.

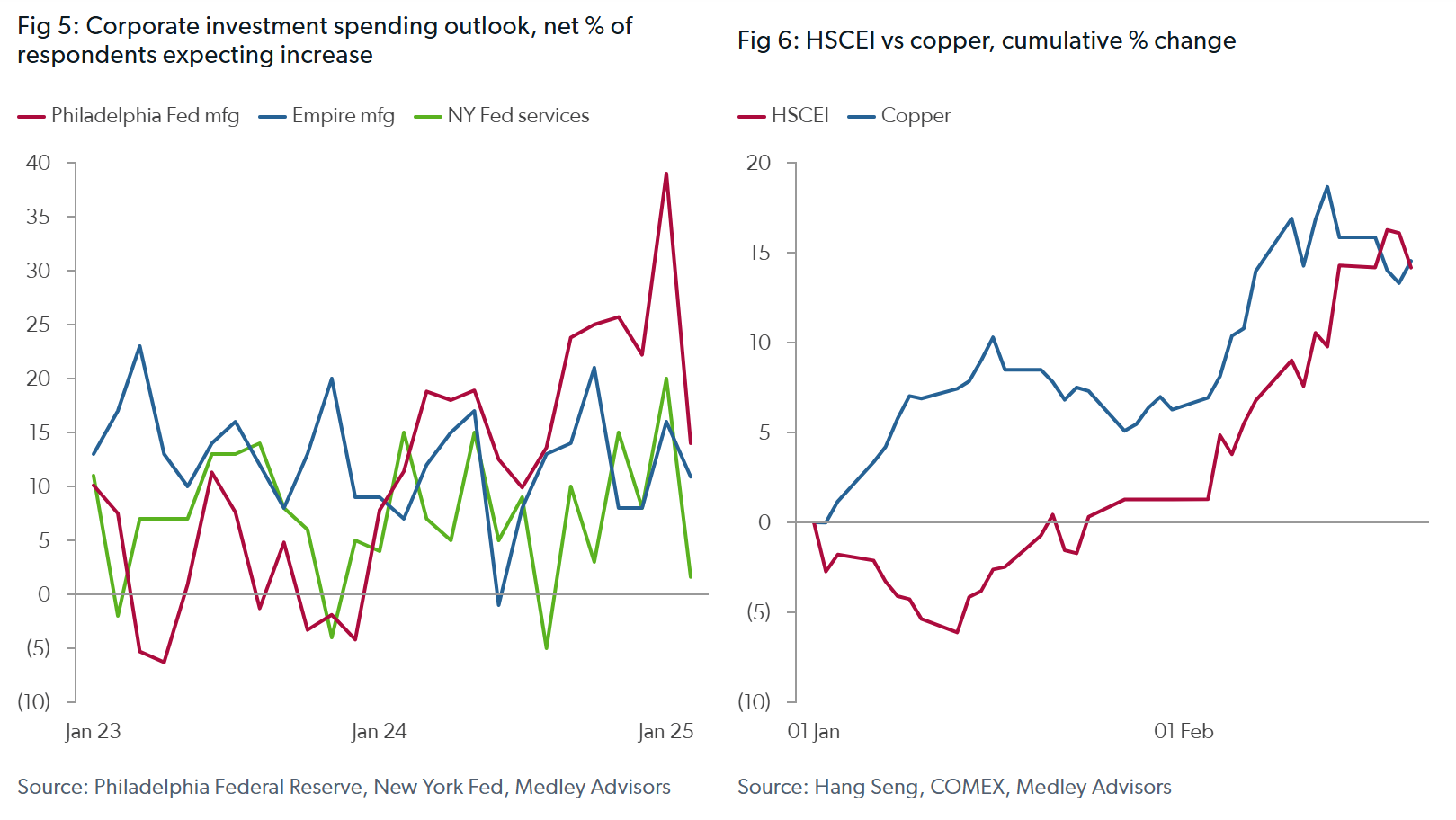

RBOB has sold off along the curve this week, but with planned maintenance in the New York Harbor starting in March and European planned turnarounds ramping up, fundamentals should temper further pressure, particularly once we are through this month’s expiry. PADD 1 stocks are high, and the March contract is exposed to winter grade destocking. We still see fundamental support from outages and closures, but the risk of a Mar-25–Apr-25 selloff is increasing given adequate stocks and softer y/y freight as participants destock ahead of the winter–summer transition. We also note that any quick progress on Dangote remains a clear risk for bullish EBOB trades (despite our expectation for a stop-start ramp-up) and for Atlantic basin octane as the initial supply permeates the region.

Refining

Global average margins are robust but mask the underlying challenges posed by narrow sweet–sour crude spreads and strong feedstocks. Global secondary unit margins are compressed, while Asian margins are just above breakeven levels. The optimisation challenge is not as acute at the prompt, as wider diesel–gasoline spreads keep refiners favouring straight-run operations. However, a lighter diet presents more issues during summer, as refiners require heavy crude or feedstocks to fill FCCs, while overhead constraints cap CDU utilisation in the event of any spike in temperatures. Narrow sweet–sour crude spreads will encourage some switching, but the volumes will be muted as there is limited room for European and US refiners to further lighten their slates, while Asia is capped by higher deep conversion capacity.

Geopolitics

The Trump administration is preparing a first wave of "maximum pressure" sanctions targeting Iranian oil flows, focusing on private smuggling networks in Iraq. Initial sanctions will likely not affect Iraqi state entities but will target private networks interacting with them. Our US government sources estimate volumes smuggled through Iraq are relatively small (under 0.1 mb/d waterborne in the south, and another 30–40 kb/d trucked through Kurdish areas). Sources add that Iraq's waiver to import Iranian gas and electricity is also unlikely to be renewed next month, potentially worsening summer power shortages. We understand the main delay in imposing these measures is that key positions in the Treasury and State departments are still being filled. That said, we expect a first wave of sanctions designations within weeks, not months.

Both Iraq’s federal government and the Kurdistan Regional Government (KRG) say that oil exports via the Iraq–Turkey Pipeline (ITP) should resume soon, although statements differ on whether this will happen this month or in early March. The potential for a restart has been rising since Iraq’s parliament approved a budget amendment in early February. The tone of recent statements suggests there are no significant outstanding issues, although we would not rule out last minute obstacles emerging given the complexity of this situation. The reopening of the ITP could restore around 0.45 mb/d of Iraqi crude flows to the Mediterranean, but underlying production would only rise by 0.10–0.15 mb/d, as Kurdish output has already partially rebounded on higher local consumption.

Macro

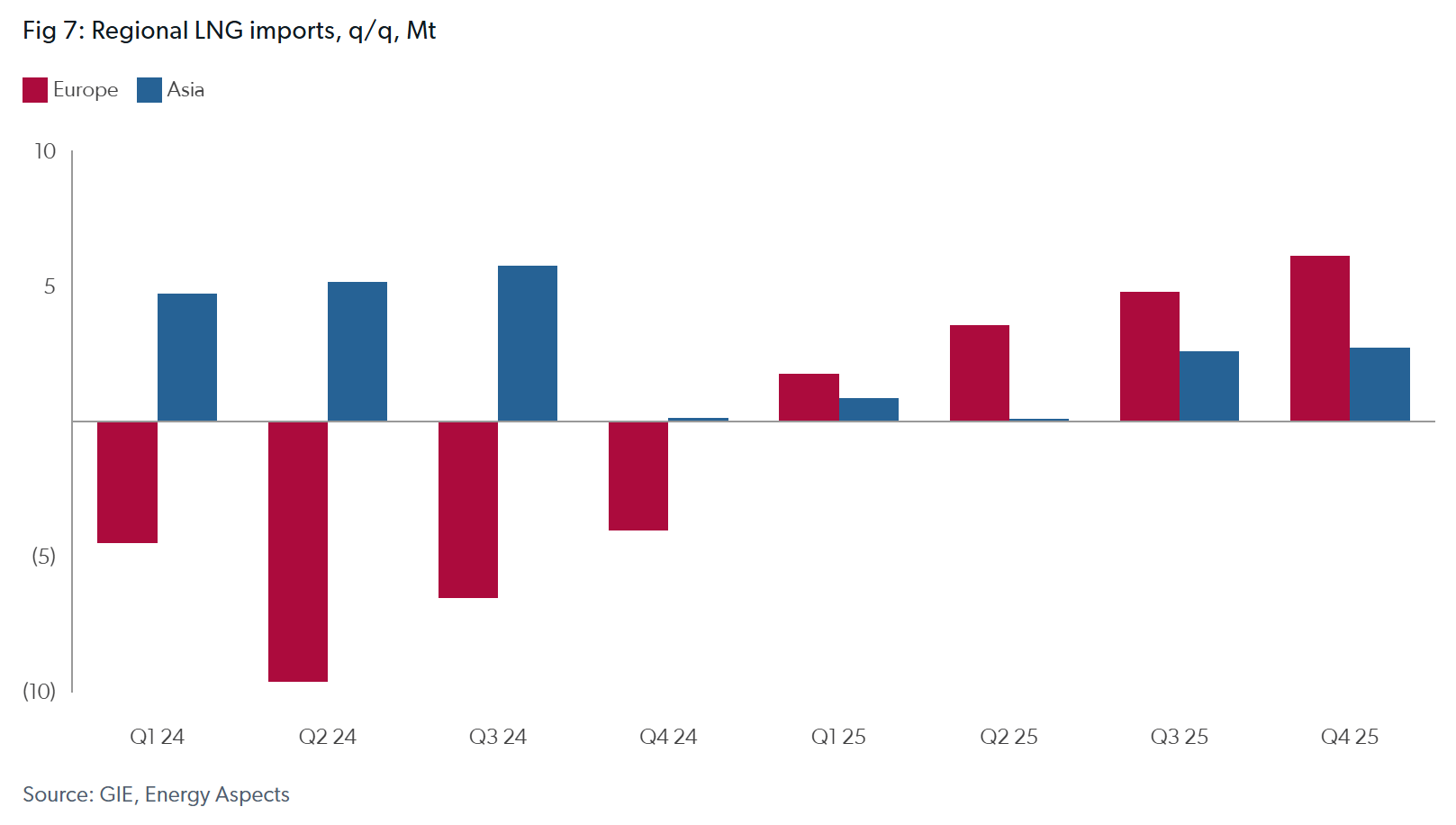

Market sentiment around the globe's two biggest economies has begun to diverge. The initial wave of euphoria around a pro-business administration in Washington has cooled as tariffs and fiscal uncertainty begin to weigh on activity. The direct impact of the Department of Government Efficiency’s cuts so far appear contained to the Washington DC area, but business surveys suggest that the overall corporate investment outlook is weakening. January's downside surprise in US retail sales could be chalked up to winter weather and holiday seasonality, but Walmart downgraded its 2025 consumer outlook this week in the face of macro uncertainty.

Sentiment around China, by contrast, continues to improve. The Chinese equity market index traded in Hong Kong (the HSCEI, which is favoured by offshore investors) has outperformed the domestic equity market by nearly 15% YTD. While much of the offshore bullishness is centred on China's tech sector, and the linkage between the Chinese stock market and the real economy is loose at best, sustained optimism could spill over into commodity markets. This is especially true for industrial metals, with copper prices moving up in lockstep with the HSCEI this year.

Natural gas

Europe gas

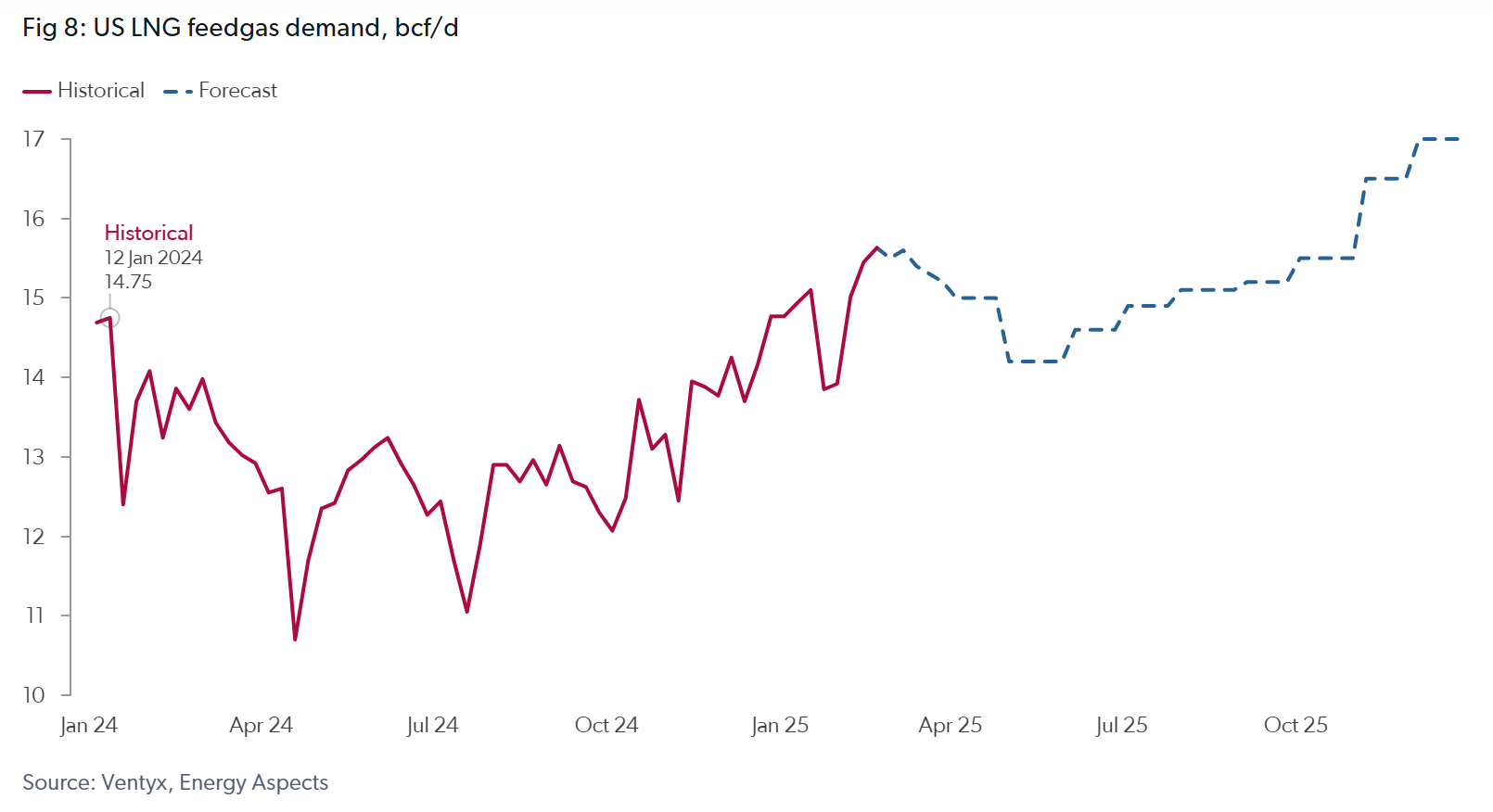

We have reduced our TTF bal-2025 forecast significantly w/w, and now see the curve near fair value after the market selloff over the past week. Our TTF bal-2025 forecast of €50/MWh is just marginally above the latest market price. We loosened our balances w/w, largely on the back of milder forecasts for the next two weeks and increased LNG supply over the coming months. Additionally, pressure from European governments to reduce storage filling mandates continues to gain traction as the Netherlands and France missed their headline 1 February targets. While there has been no official relaxation of storage targets, we expect Europe will be able to reduce its efforts to constrain gas demand and attract LNG over the injection cycle.

We have maintained that there will likely be a Russia–Ukraine peace deal later this year, but we remain sceptical this will translate into the return of Russian pipeline gas to the European market. Political opposition across the EU to the return of Russian pipeline gas remains high due to Russia’s weaponisation of these flows throughout the war. Russian LNG exports have a greater chance of rising following a peace deal as the US controls those sanctions, but we only see this happening as a hard-won concession. A quick ramp-up of Russian gas exports from mid-year, albeit far below historical levels, would significantly reduce European gas prices.

Global LNG

JKM–TTF summer 2025 spreads continue to move up towards our forecast following the recent selloff in TTF. The latest CME settlements of JKM–TTF summer 2025 spreads averaged only marginally below Yamal shipping differentials via the Northern Sea Route (NSR), which we have identified as the support level for spreads this summer. Asymmetric upside risks on the TTF will likely continue to deter JKM–TTF spreads from rising significantly, as we expect Europe’s increasing dependence on flexible LNG supply to continue reducing availability for price-sensitive Asian demand through the summer. We expect this to result in LNG demand increasing by 1.2 Mt y/y in Asia and 8.4 Mt y/y in Europe.

North America gas

Henry Hub breached $4.00/MMBtu down the curve this week as weather forecasts continue to drive volatility in US gas markets. Colder forecasts continue to tighten balances, causing our storage carryout to slip to 1.55 tcf. We have raised our summer 2025 forecast by $0.35/MMBtu to $3.97/MMBtu on the need for a higher summer build to reach an end-October 2025 storage level that will provide enough cover for a normal winter 2025–26. We expect elevated prices to loosen balances over the summer by reducing price-sensitive power burns by 0.9 bcf/d and incentivise new dry-gas drilling to lift production in H2 25. Incremental production and sufficient storage fill will be crucial in supporting the elevated feedgas demand that we expect in H2 25 and 2026.

Transition

In September 2024, the Biden administration quadrupled US tariffs on Chinese electric vehicles (to 100%) and lithium-ion batteries (to 25%) and doubled tariffs on solar cells and polysilicon (to 50%). Trump’s 10% across-the-board tariff on China brings average tariffs on most Chinese industrial goods to 35%, a figure that may rise to as high as 60% in the coming years. The EU has imposed similar tariffs on Chinese EVs, which now reach as high as 45.3% for some models. Chinese firms are rapidly pushing exports of EVs, batteries, and solar and wind equipment to the Global south due to the rising trade barriers among advanced economies, particularly within clean tech industries. This will likely be accompanied by investment in manufacturing facilities in countries such as Thailand, Brazil and Turkey, accelerating EV adoption rates in emerging markets by 2030.

Related insights