Insights

Released last week for Energy Aspects subscribers, our latest Crude Oil analysis examines the complex dynamics affecting Cushing balances and US crude exports through summer 2025. What you'll discover in this analysis: How weak USGC export demand and Midcon light crude strength could alleviate June-August Cushing tightness. Why high Murban availability from OPEC8+ production unwinding is limiting Asian WTI demand. The critical role of Basin pipeline as a swing factor for Cushing balances. How Cushing's ability to secure marginal Midland barrels could cap WTI timespreads upside.

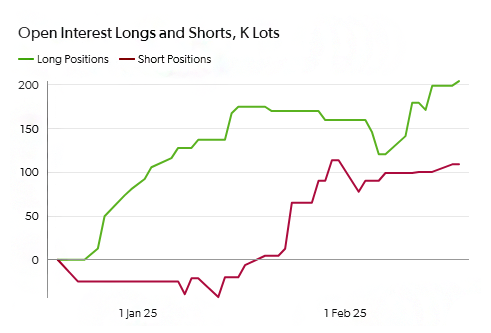

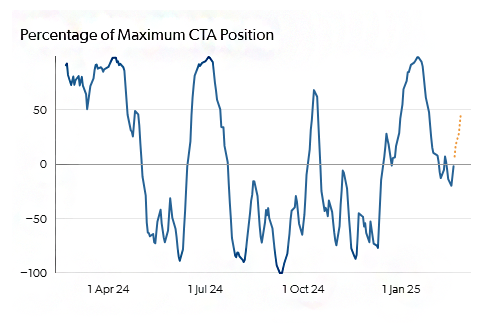

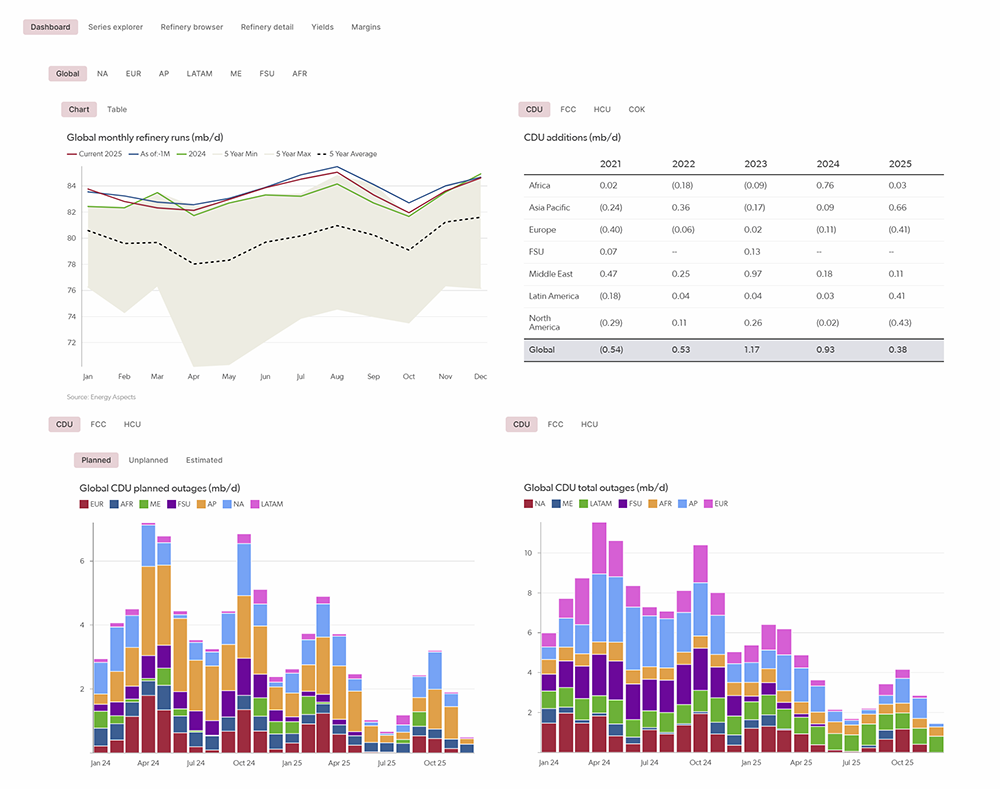

The OilX Trader Tool translates high-frequency fundamental data into actionable trading signals, helping you anticipate market movements before prices react. By integrating OilX's physical market data with EA Quant Analytics' financial flow positioning metrics, the tool predicts how speculative traders will respond to changing fundamentals over a 1-3 week horizon. View the trader tool in action below:

Recently released for Energy Aspects subscribers, our analysis reveals a challenging outlook for oil field services companies. Q1 2025 earnings for Baker Hughes, Halliburton, and SLB dropped by a third quarter-on-quarter, to a combined $1.7 billion, the first such decline since Q1 2024. What you'll discover in this analysis: Major OFS companies' earnings trends and industry health outlook for 2025. Contrasting performance between tight oil activity and deepwater operations. Tariff implications for OFS supply chains and equipment manufacturing. Regional market performance across North America, Mexico, and Saudi Arabia. Strategic responses to shareholder expectations during market turbulence.